If you’re a renter, a landlord will likely pull your credit report before approving you for a lease. That’s because most landlords examine your credit history as part of the tenant screening process. It’s a way for them to assess the risk that you’ll fail to pay rent on time.

There are two types of credit checks: hard credit checks and soft credit checks. Both have different implications for your credit score, particularly in the context of rental applications, so it’s helpful to understand how they each work. In this article, we’ll break down the differences between a hard vs soft credit check and how each impacts your credit health.

What is a hard credit check?

A hard credit check occurs when an individual or company reviews your credit report as part of its loan application process. Hard credit checks, also known as hard pulls or hard inquiries, are typically performed to determine whether you qualify for a loan.

You can expect to undergo a hard credit check when applying for most loans: credit card, line of credit, car loan, mortgage, etc. A hard check is integral to the loan application process—you won’t get to borrow money without it.

Each hard credit check you incur is recorded on your credit report and negatively impacts your credit score. How much will your score drop? There’s no clear-cut answer, as each person’s credit situation is unique. But if you have a high score, the effect of a hard inquiry will be negligible, most likely—it might shave off five points or less. However, multiple hard checks over a short period can exert considerable downward pressure on your score.

Hard credit checks stay on an Equifax credit report for up to three years and up to six years on a TransUnion credit report. Because of the adverse influence on your credit history, someone wishing to do a hard pull on your report must obtain your consent.

What is a soft credit check?

A soft credit check happens when someone reviews your credit report to prequalify you for a loan or other service. Unlike a hard inquiry, it’s not part of the decision-making process that determines whether you get approved. Instead, a soft check is more like a brief evaluation to see if you meet specific criteria to apply in the first place.

Soft credit checks are less intrusive than hard checks, offering lenders and other authorized users only surface-level information about your borrowing history. Here are examples of instances when you may encounter one:

- Credit limit increase. Your credit card provider routinely conducts soft checks to decide whether to offer you a credit limit increase.

- Pre-qualification for a mortgage. Mortgage pre-qualification allows you to estimate how much you could borrow to finance your home. Getting prequalified always involves a soft check, while a pre-approval requires a hard check.

- Employer background check. A potential employer may want to check if your finances are in good shape to assess your trustworthiness and responsibility. This is common for roles that involve handling money or safeguarding sensitive information.

Soft credit checks have no impact on your credit score. While they get recorded in your credit report, they are visible only to you. Lenders and other authorized users, such as employers and landlords, will never see them when reviewing your credit history. As a result, you never have to worry about third parties constantly pulling your report—your credit score will remain intact.

Since soft credit checks disclose little financial information and play no direct role in the application process, lenders and other legitimate users don’t require your permission to conduct one.

Rental credit checks and credit reports

Applying to be a tenant usually involves passing a credit check. This makes sense, as landlords want to see evidence that you’re financially capable of paying rent on time. Many landlords rely on a tenant report to get this information, as it provides a more complete view of a renter’s financial reliability.

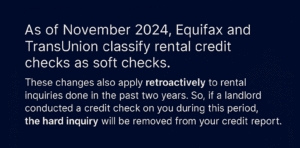

Unfortunately, these rental credit checks would be recorded as hard inquiries, which could hurt your credit score. The negative impact could be significant if you incur a slew of them over a short period, which is possible when applying to multiple rentals. However:

As the rental applicant, you’ll still be able to see the hard inquiry when viewing your credit report online in your Equifax or TransUnion account. But no one else will, including landlords. Given these positive changes, you can freely apply to as many rentals as you wish without any repercussions to your credit score.

Benefits of the change in rental credit checks for renters

Here’s why the change in the treatment of rental credit checks benefits you as a renter:

Credit score stays safe. You never have to stress about your credit score suffering each time you apply for a new place, even if your credit report is pulled multiple times in one day.

No penalty for exploring options. You can search far and wide for your next rental property without worrying about damaging your credit. With the anxiety and dread gone, it’s easier to devote more time and energy to finding the perfect leasing opportunity.

Confidence in applying. You can apply for tenancy at rentals at ease, knowing that rental credit checks won’t negatively impact your credit score.

More room for loan applications. Since rental credit checks no longer affect your credit score, you have more leeway to shop around for loans. The combined adverse effect of loan and rental applications will be less severe since the latter doesn’t count as a hard inquiry.

Faster credit score improvement. With rental credit checks no longer hindering your progress, building up your credit score will take less time and effort, especially if your landlord reports rent payments to the credit bureaus.

Our final thoughts

When someone pulls your credit report, the inquiry counts as either a hard or soft check, depending on the purpose of the review. A hard credit check is logged in your credit report for several years and harms your credit score. In contrast, a soft credit check does not impact your score and is visible only to you.

Credit checks are done primarily by lenders to decide whether to approve you for a loan. But landlords also rely on them to determine if you’re financially stable enough to handle rent payments. The good news is that Equifax and TransUnion now treat rental credit checks as soft inquiries. As a result, you can apply to be a tenant at rental properties as often as you like without damaging your credit.

For more tips on how to boost your credit score, check out our article on how tenants can improve their credit scores.