Sometimes, a prospective tenant’s credit score doesn’t tell the whole story. You might want to give someone a chance, especially if they’ve made a great impression. To ensure they can pay rent on time, you need to validate their financial reliability through their past rent payments and recent pay stubs.

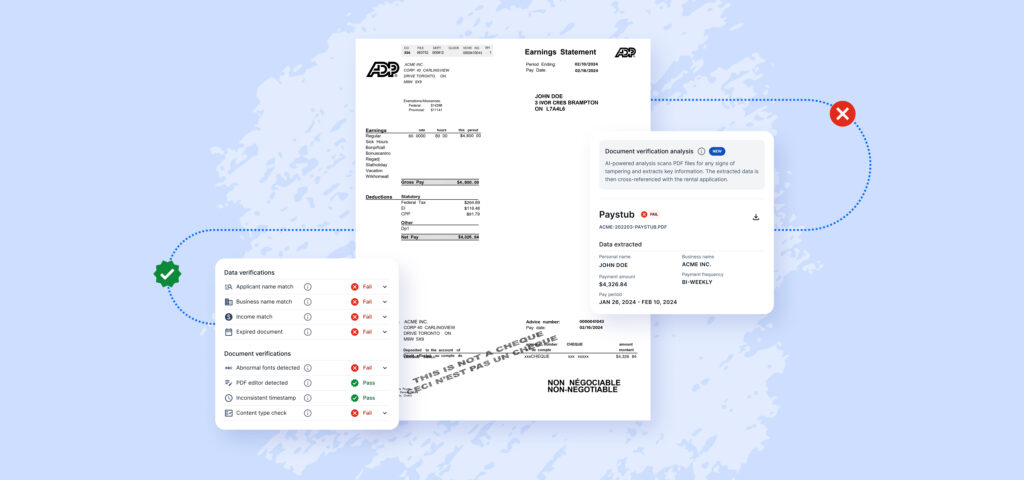

With SingleKey’s new AI-powered document verification tool, we automatically scan income documents for signs of editing or fraud. Any issues detected will be highlighted in the ‘Uploaded by tenant’ section of your Tenant Report, making it easy for you to identify and review any documents of concern by simply clicking into them for the full analysis.

Best of all, this tool will be included for free with no additional costs on all Equifax, TransUnion and Dual Reports (Equifax and TransUnion) for a limited time.

Explore the video below for a quick walkthrough of the document verification feature, or read on for full product details.

How SingleKey’s document verification works

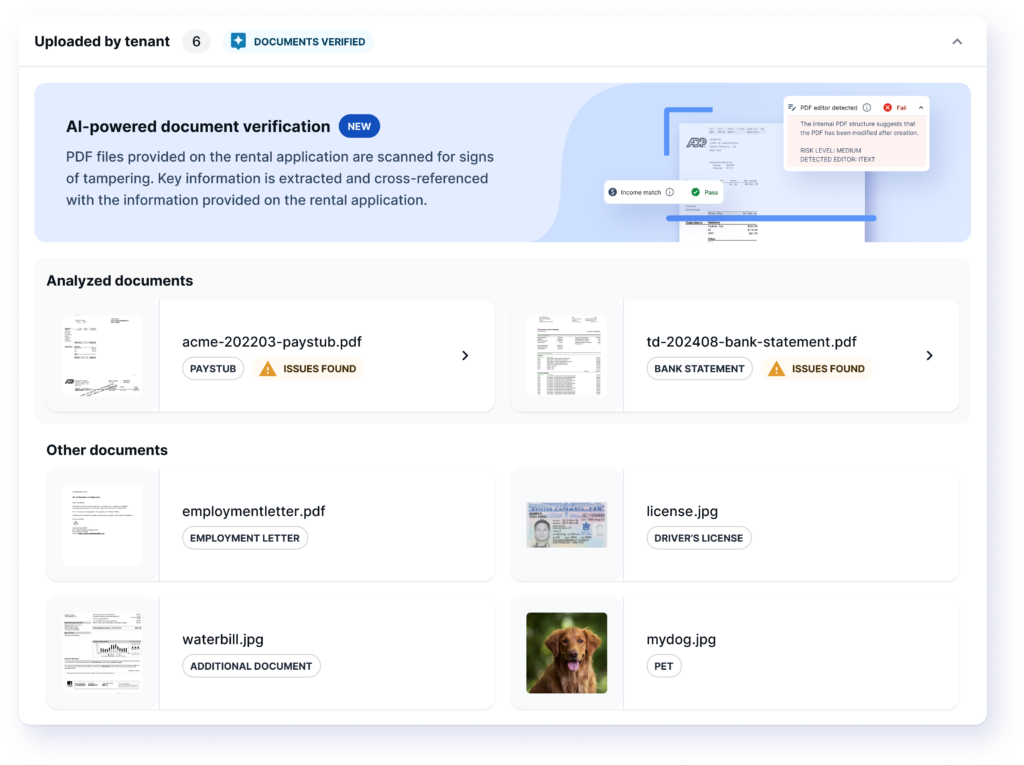

The first three rental documents uploaded by the rental applicant will be scanned and verified by our system. This feature works on standardized documents, like pay stubs and bank statements.

Once the documents have been uploaded, they’ll be summarized in a single view. This helps you quickly understand which items haven’t passed our document verification process.

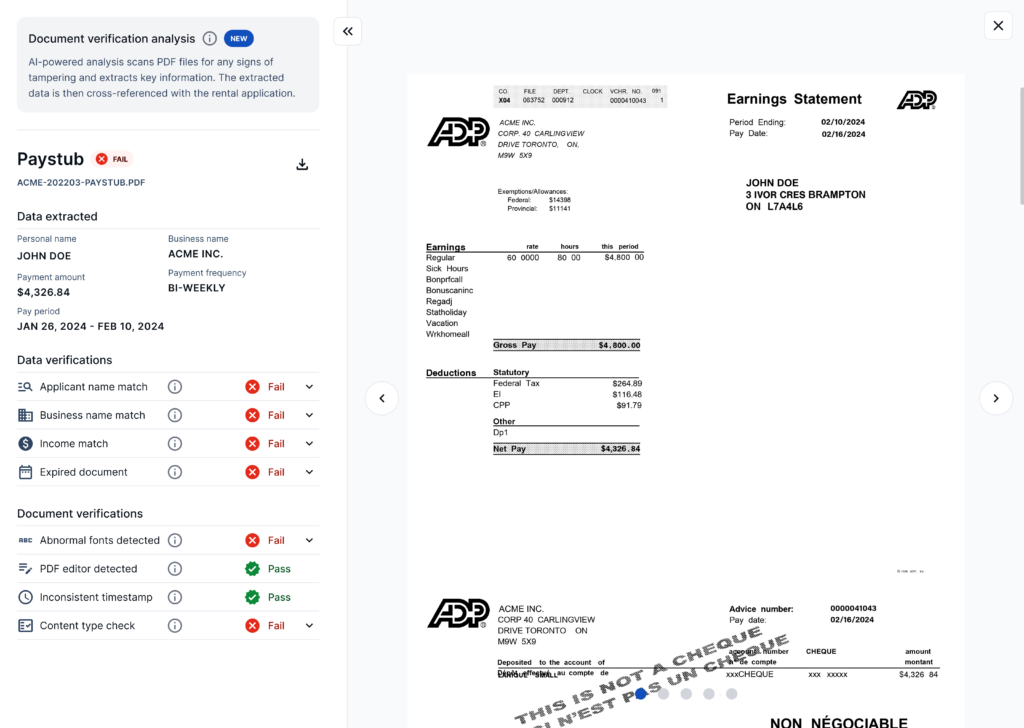

During the verification scan, our system extracts the data from the uploaded document and uses AI to see if it matches the information the tenant provided on their rental application. This produces a summary of passes or fails based on several criteria.

Document verification criteria

Here’s a look at the items we check on each document:

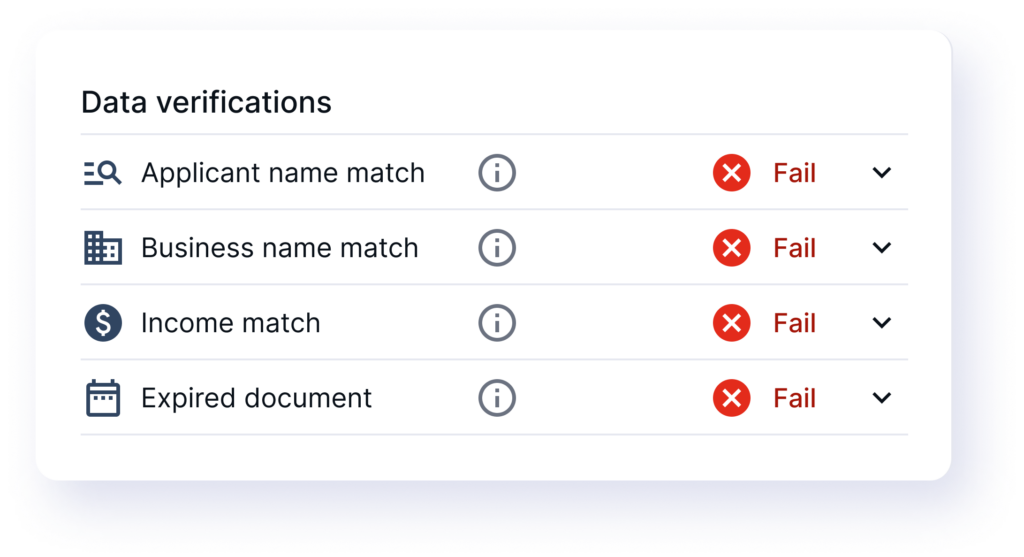

Applicant name match

This detects if the applicant’s name from the rental application is shown in the document.

Business name match

We’ll identify if the business name from the rental application is shown in the document.

Income match

This indicates if the monthly income provided on the rental application matches the monthly income extracted from the uploaded document. Our system will display a pass if the income on the document is higher, or if it’s within 10% of the income stated on the application.

Expired document

Using the most recent date found, this checks if the document is over 60 days old.

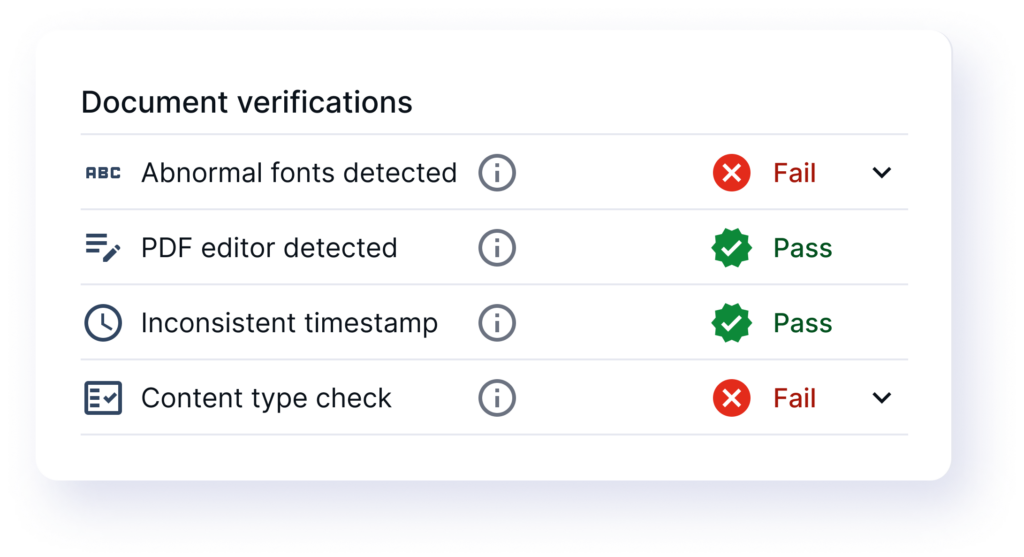

Issues detected by the document verification tool

After a series of document fraud analyses, the document verification tool will flag any items that don’t match the information provided by the tenant on their rental application. Here are some of the issues our verification process picks up:

Abnormal fonts detected

This means that the fonts are inconsistent with the rest of the document. This could indicate that the document was previously modified.

PDF editor detected

One of the easiest ways for a document to be altered is by using a PDF editor. Our system will flag this if there are signs that a PDF editor has been used.

Inconsistent timestamp

The “modified date” of a digital document should match the “created date.” If they don’t match, there’s a high chance the document has been tampered with.

Content type check

This check fails our verification process if the uploaded PDF is scanned or contains only images. In this case, it’s difficult to confirm authenticity, so it’s a risk.

Our final thoughts

It’s easy to tamper with rental documents like bank statements and pay stubs. That’s why it’s crucial for landlords to double check that the information provided during the application process is authentic.

To assess potential tenants accurately, SingleKey’s document verification feature helps validate all the supporting material that comes with rental applications. To get started with this tool, log in to our platform and start screening your tenants. You can also learn more about how SingleKey helps protect landlords from rental fraud.