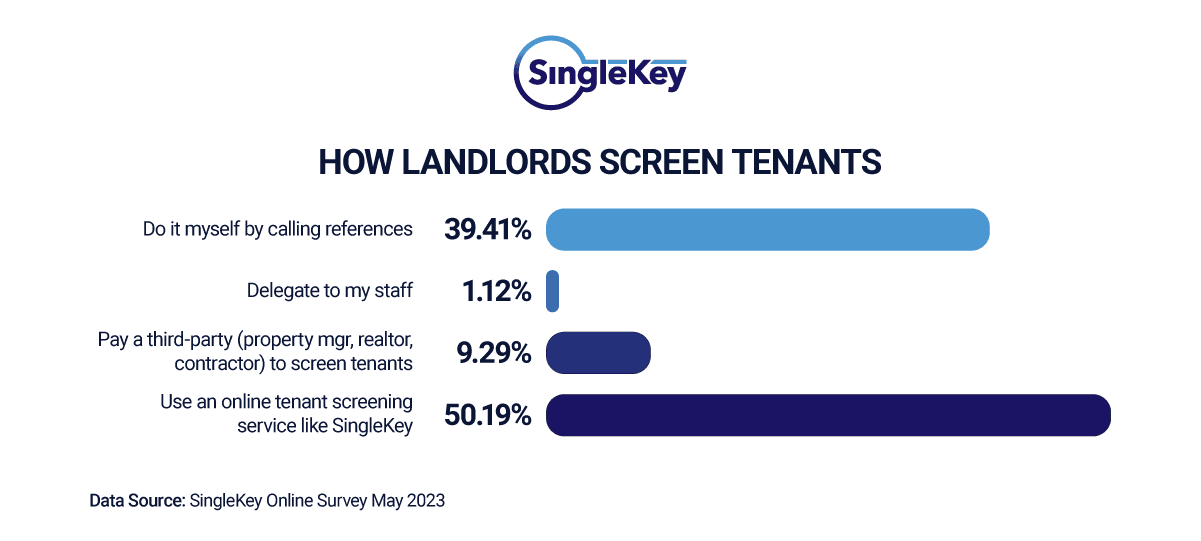

SingleKey surveyed over 200 property managers recently to learn their preferred methods for managing the tenant screening process. The results suggest that most landlords favour using an online tenant screening service.

Online tenant screening services provide landlords with relevant information to help them deduce the best candidates for their rental units. We’ll review the various approaches landlords use to screen tenants and rank each response.

Use an online tenant screening service

The survey found that 50 percent of respondents employ an online tenant screening service to help filter prospective tenant applications to find their ideal tenant. Utilizing an online tenant screening platform will expand the scope of your search by providing comprehensive reports that include pertinent information on potential tenants that include:

- Criminal background checks

- Credit history

- Eviction records

- Income verification

Online tenant screening services have been a lifeline for many landlords looking to protect their property and ensure timely rent payments. Virtually all online tenant screening reports can be purchased by landlords with an applicant’s consent at affordable costs.

While enlisting an employee may seem like an adequate and less expensive recourse, a lot can fall through the cracks, and with a SingleKey Tenant Report, you are guaranteed to get accurate results fast.

Hiring a realtor, real estate attorney, or contractor can become costly. Small landlords owning 50 or fewer rental units benefit the most from cost-effective, fast, and reliable tenant screening results.

The do-it-yourself approach to tenant screening

Less than 40 percent of landlords take it upon themselves to screen tenants by solely calling references. This method is problematic for several reasons. Most professional property managers report that calling references is essential in checking if the prospective tenant has a good standing relationship with previous landlords. However, all of the other relevant information, such as criminal history and credit scores, will be beyond the landlord’s purview when considering a potential tenant for the rental property.

A landlord needs to ask a prospective tenant many questions during the screening process. With income verification, a landlord will know if the applicant has a good rent-to-income ratio. Tenant screening reports also reveal criminal history, credit scores, and hard inquiries on a credit report. A landlord will want to know if the applicant has made sound financial decisions in the past, or if they have substantial debt.

There’s always the possibility that a prospective tenant will falsify information on their application, including employment history and tenant references. Before landlords can verify employment history, they must get consent from the applicant. Learn how to verify employment history for potential renters by following these guidelines:

- Get permission to verify employment history

- Contact employer to confirm employment status

- Request previous pay stubs or proof of income

In addition to confirming employment status, you can ensure potential renters have a good rent-to-income ratio. A handy tool for landlords is the formula for determining the rent-to-income ratio: (monthly rent/gross income) x 100.

Credit checks can paint a big picture of an applicant’s debt-to-income ratio. This figure will help you to quantify if the potential tenant can afford the monthly fixed payments and rent.

Hire a third party to help screen tenants

Just over 9 percent of homeowners would consider hiring a third party to screen their tenants. A third party can include a professional property manager that is not the property owner, a realtor or contractor specializing in rental properties, or a real estate agent acting as a property manager.

If you’re a homeowner looking to hire a property manager to handle the entire rental process, a property manager typically will charge a monthly fee. The fee varies depending on the city and the property management company. Expect to pay between 5 percent and 15 percent or more of the rent. There are numerous methods of screening that a property manager may use, including pulling a credit report or checking references.

Interviewing a property manager is equally important as interviewing a prospective tenant. You want to ensure they adequately screen prospective tenants and will be adept at handling problems if they should arise.

Another point to note is that it’s uncommon for property owners to have a real estate attorney on hand overseeing the vetting and rental process unless the rental units are luxury, high-rises, or the rental is in a location where it’s customary to have a lawyer conduct the vetting process. There may be more to understand in these instances and having a lawyer would make more sense.

Costs can quickly add up with a third party managing the tenant screening process. For landlords operating less than 50 rental units, it’s more economical to use a self-serve tenant screening platform.

Delegate tenant screening tasks to staff

Only one percent of landlords delegate the tenant screening process to their staff. Tenant screening is one of the most vital steps in the rental process, which is why most homeowners recruit the help of an online tenant screening service instead of entrusting this task to a staff member. With an online tenant screening service, landlords can rest assured that nothing will fall through the cracks.

Before landlords approve a prospective tenant, they must prioritize a quick and foolproof method that ensures the renter is trustworthy and can pay the rent.

With a tenant screening service like SingleKey, there are resources and features built in to ensure property management is risk free. For example, SingleKey provides landlords with resources to understand how to navigate the Fair Housing Laws and other regional reforms.

FAQ: How do landlords screen tenants?

The most extensive and effective way to screen rental applicants is by using an online tenant screening service that produces quick and tamperproof results. Here are steps you can take to screen tenants like a pro using this screening checklist for landlords:

- Confirm applicant’s identity

- Check references

- Verify income

- Review credit reports

- Conduct a background check

Before you can run a background check to verify employment history and rental history, you must obtain consent and ask for the following information:

- Basic information, including full name, DOB, residential address

- (Optional) Social Insurance Number (SIN)

- Drivers license number

- Previous addresses

- Email address

- Proof of income, including paystubs

There are various ways you can protect yourself as a landlord:

- Understand the tenant screening laws in Canada and the tenant screening laws in the U.S.

- Screen tenants carefully

- Incorporate a lease agreement

- Obtain a security deposit

- Conduct multiple inspections

- Keep all rental documents organized

Using a SingleKey Tenant Report will reveal criminal records during the application process and help minimize the risk of late payments. The report also helps you confirm a person’s sources of income, which is a helpful indicator of a prospective tenant’s financial stability.

Attracting tenants to your property can be accomplished in various ways, including:

- Placing an advertisement on a rental listing website

- Word of mouth

- Putting a “For Rent” sign on the property

- Advertising on social media

Using all of these methods of advertising will attract the most attention.

Our final thoughts

Professional support in the tenant screening process and access to helpful features in a tenant screening platform can relieve your rental concerns. Services like SingleKey offer top-of-the-line features and resources, as well as a comprehensive Tenant Report, to help you find the best tenant for your rental property.