- Rent Guarantee

- 6 Minute Read

Rent Guarantee Demand: What It Is and the Most Common Types

Key Takeaways

- SingleKey's Rent Guarantee Program protects your rental income against losses from unpaid rent, property damage, and eviction costs. To receive financial compensation, you must submit a demand, which requires providing information about the incident that resulted in the loss.

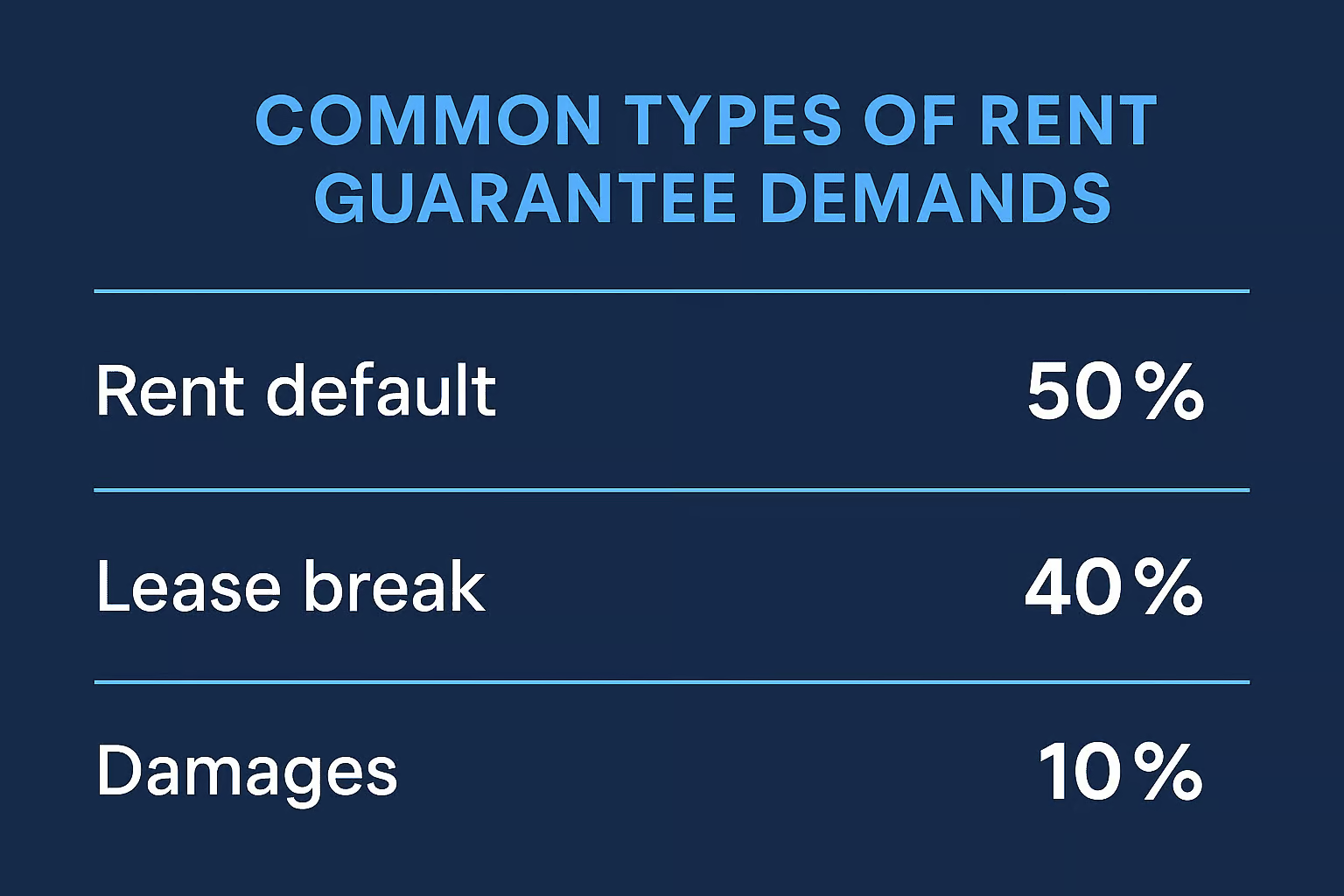

- The most common demands under the Rent Guarantee are rent payment defaults and lease breaks (where a tenant fails to serve the landlord with property notice before vacating the property). Property damage demands also occur but are rare.

- The top reason that a tenant stops paying rent is because they're experiencing financial hardship or have lost their job.

Updated on Jul 24, 2025

Written By:

Verified By:

Running a rental property can be a lucrative way to earn a steady income — but only if your tenant pays rent on time. Tenants who default on their rent payments are the most significant risk you face as a landlord. It can cost you thousands of dollars in lost revenue, eviction fees, and other costs.

In this article, we’ll examine tenant defaults and other risks that landlords face in the rental market today using data from our Rent Guarantee Program. We’ll also show you how the Rent Guarantee Program protects your rental business against these risks, giving you peace of mind and financial security.

What is a Rent Guarantee demand?

SingleKey’s Rent Guarantee Program is a service designed to protect landlords against the financial risks of renting out their properties. It compensates you for lost rental income due to tenant defaults, property damage, and legal fees for evicting a non-paying tenant. It also provides you with a paralegal team to assist you through the eviction process, if necessary.

If your tenant stops paying their rent, you must submit a demand to SingleKey. A demand is a request for reimbursement under the Rent Guarantee Program. Under this process, you explain the key details surrounding the tenant default, which SingleKey will review. Once we approve your demand, you’re entitled to financial compensation through the Rent Guarantee Program.

Submitting a demand to SingleKey is fast and easy—you can complete the whole process online in a few minutes. Learn more about raising a demand with SingleKey.

Common types of Rent Guarantee demands

Now that you understand what demand is, let’s examine some of the most common types that landlords enrolled in the Rent Guarantee Program submit to us. This will give you an idea of the most likely risks you may encounter while running a rental property. The statistics in the table below are as of July 2024.

The most common demand is a rent payment default, accounting for 50% of submissions we receive. A rent default occurs when your tenant stops paying their rent or falls behind on their payments. Under the Rent Guarantee Program, SingleKey covers up to 12 months of lost rent (up to a maximum of $60,000).

The second most common demand is a lease break, making up 40% of total submissions. A lease break occurs when your tenant leaves your rental property without giving you proper notice. The notice period required for tenants varies depending on your property’s location, but it’s usually between 30 and 60 days. SingleKey provides rent coverage for up to 30 days in the event your tenant abandons your rental without notice.

Property damage accounts for 10% of the demands we receive from landlords. Under the Rent Guarantee Program, “property damage” refers to “unpaid court-ordered malicious tenant damages.” In other words, your tenant willingly vandalized your rental and is legally responsible for the repair costs but hasn’t paid you. The Rent Guarantee Program offers up to $10,000 in property damage protection.

Common reasons for tenant non-payment of rent

Financial hardship or job loss is the primary reason tenants fail to pay their rent on time, making up 50% of the total Rent Guarantee demands we receive. This statistic isn’t surprising, as rent is usually a tenant’s largest expense. If most of their income goes toward rent, all it takes is one financial setback for them to stay caught up on payments. That’s why, as a landlord, it’s crucial to measure a tenant’s rent-to-income ratio—the higher it is, the greater the risk of default.

The second most prevalent reason for non-payment of rent stems from tenants who intentionally withhold payments. It accounts for 30% of rent defaults. This situation frustrates landlords since the tenant has the means to pay but refuses to do so. A thorough tenant screening process can help weed out such individuals, but not always. Some will slip through the cracks, as it’s impossible to predict with 100% accuracy how a tenant will behave once they move in.

A breakup or divorce is the third most common reason tenants fail to pay their rent, appearing in 20% of Rent Guarantee demands. In such cases, a couple rents out a home, and their combined income is sufficient to cover the monthly rent. However, when the relationship breaks down, one party often leaves the property, leaving the other to struggle with paying the rent on their own.

While tenants can default on their rent for many reasons, it’s essential to understand that it can happen at any time. Your tenant can stop sending you money after a couple of months of moving in or after five years. That’s why it’s vital to have a plan in place that allows you to weather these financial losses, should they occur.

Screen applicants thoroughly with credit, background, and income verification—so you reduce risk, avoid surprises, and protect your rental income.

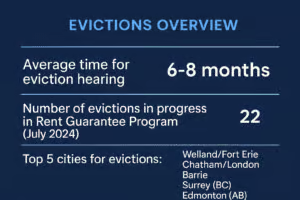

Evictions overview

Some demands under the Rent Guarantee Program result in the landlord having to evict their tenant. While we equip landlords with various tools and resources to help avoid this situation as much as possible, eviction may sometimes be necessary to address a delinquent tenant.

The average time for landlords to get an eviction hearing is 6 to 8 months. As of July 2024, 22 evictions are in progress through our Rent Guarantee Program, with most located in the following cities: Welland/Fort Erie, Chatham/London, Barrie, Surrey, and Edmonton.

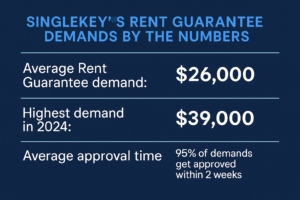

SingleKey’s Rent Guarantee demands by the numbers

The average Rent Guarantee demand for 2024 is $26,000. This amount consists primarily of lost rental income and legal fees. Our highest demand in 2024 so far was $39,000, consisting of 12 months of lost rent, court fees, and sheriff fees to remove the tenant from the property.

These numbers highlight the financial risk landlords assume when renting out their properties. When your tenant stops paying rent, your losses can add up quickly, especially if you have to endure a lengthy eviction before finding a replacement tenant.

Luckily, 95% of SingleKey’s Rent Guarantee demands get approved within two weeks! This can bring you tremendous peace of mind if you’re concerned about the financial security of your rental business.

Our final thoughts

When it comes to the pitfalls of renting out a property, few are worse than a tenant who suddenly stops paying rent. Losses stemming from lost rental income can be substantial. Add court fees and property damage, and you could face tens of thousands of dollars in out-of-pocket expenses.

There’s no way to foresee any of these scenarios in advance—you can only do your best to prepare for them. Enrolling in the Rent Guarantee Program allows you to do exactly that. Should your tenant default on their rent or damage your property, SingleKey will review your demand and compensate you for your loss, relieving you of the massive financial stress you’d otherwise face.

Learn more about how to protect your rental income with the Rent Guarantee.

Learn more about Rent Guarantee

Learn more about Rent Guarantee

- How to Sign Up for the Rent Guarantee

- How to Protect Your Rental Income with SingleKey’s Rent Guarantee

- Pro Landlord Tips: How SingleKey’s Rent Guarantee Reduces Rental Risks

- How SingleKey’s Rent Guarantee Helps Landlords During the Eviction Process

- Comparing Canadian-Provided Rent Guarantee Programs

- SingleKey’s Rent Collection Tool vs Rent Guarantee Program – What’s the difference?

- What Is a Guarantor on a Lease?

- How the Tenant Guarantor Program Reduces Risks for Landlords

- Rent Guarantee Demand: What It Is and the Most Common Types

- What is Rent Guarantee Insurance?