Screening Products

Features

Get credit and financial data from both credit bureaus to see the full picture

Easy, mobile friendly, and comprehensive online rental application form

We will contact your tenant’s references and share a recording and summary of the call

Search eviction court records from Openroom, CanLII, and SOQUIJ

AI-powered scan of income documents to detect signs of tampering or fraud

Confirm a tenant’s identity with AI-powered ID verification and liveness check

More Resources

Free Lease Agreement Forms for each province in one place

Conversations on real estate trends and property management strategies

Local tools and resources to help you manage your rental property successfully

Learn how to solve renting challenges from our experts

Articles on how to navigate the in-app SingleKey experience

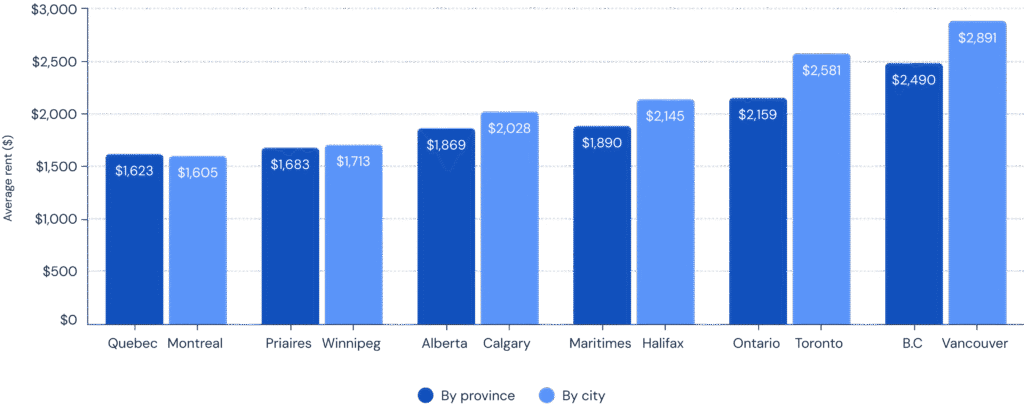

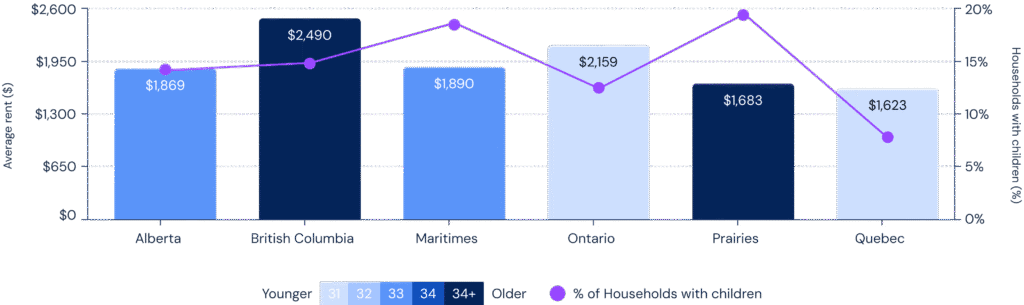

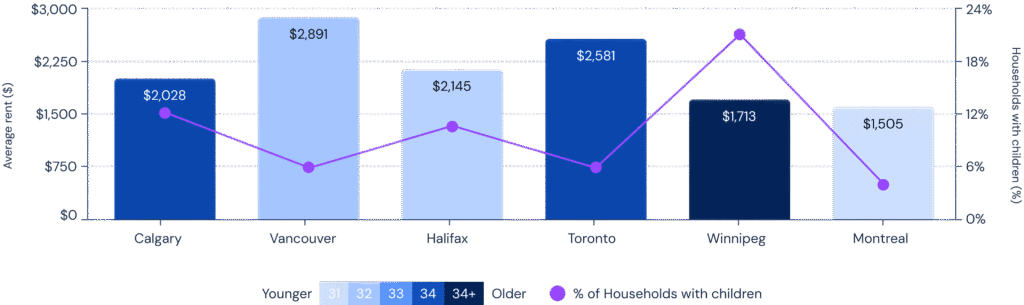

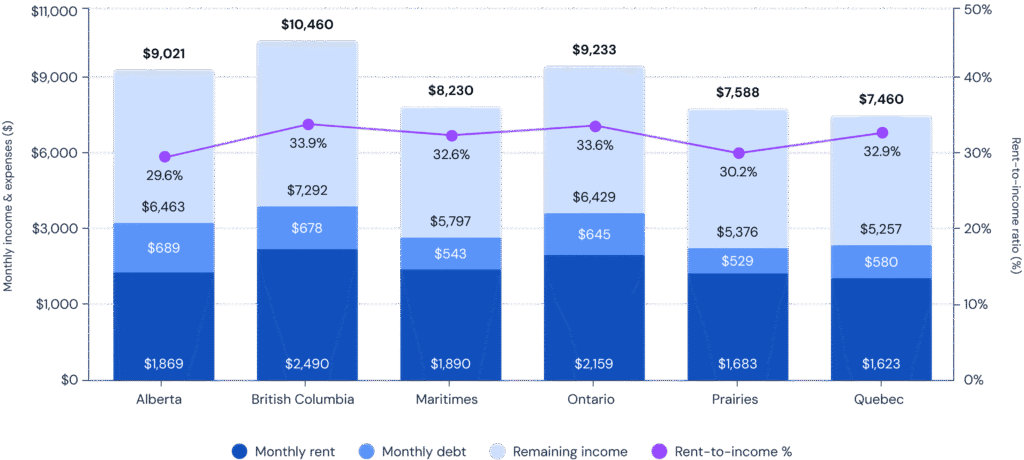

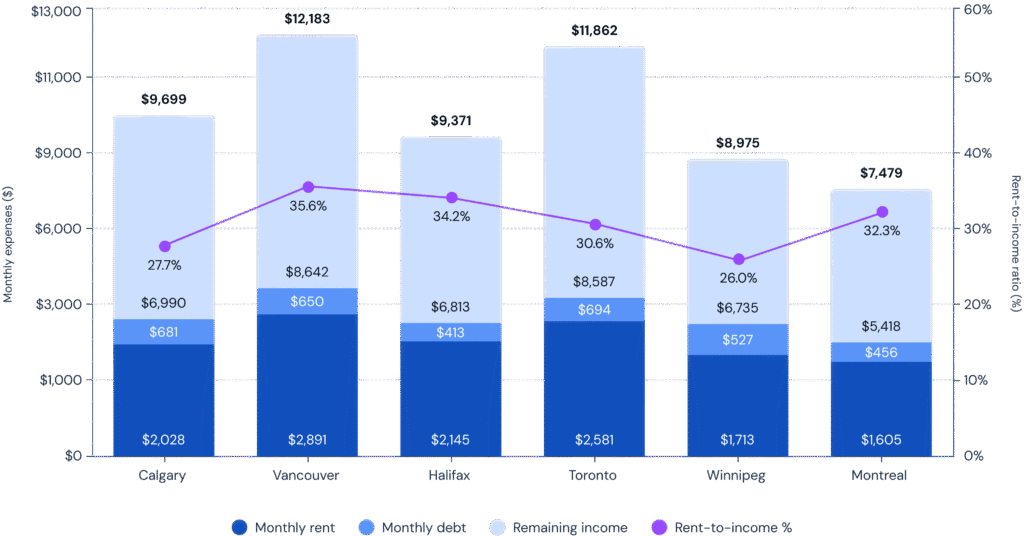

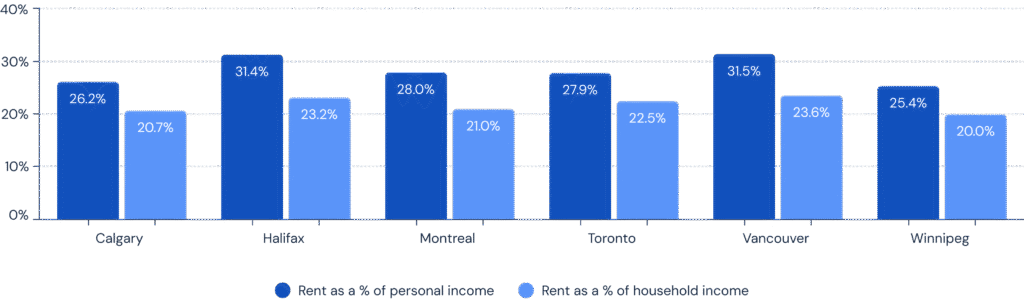

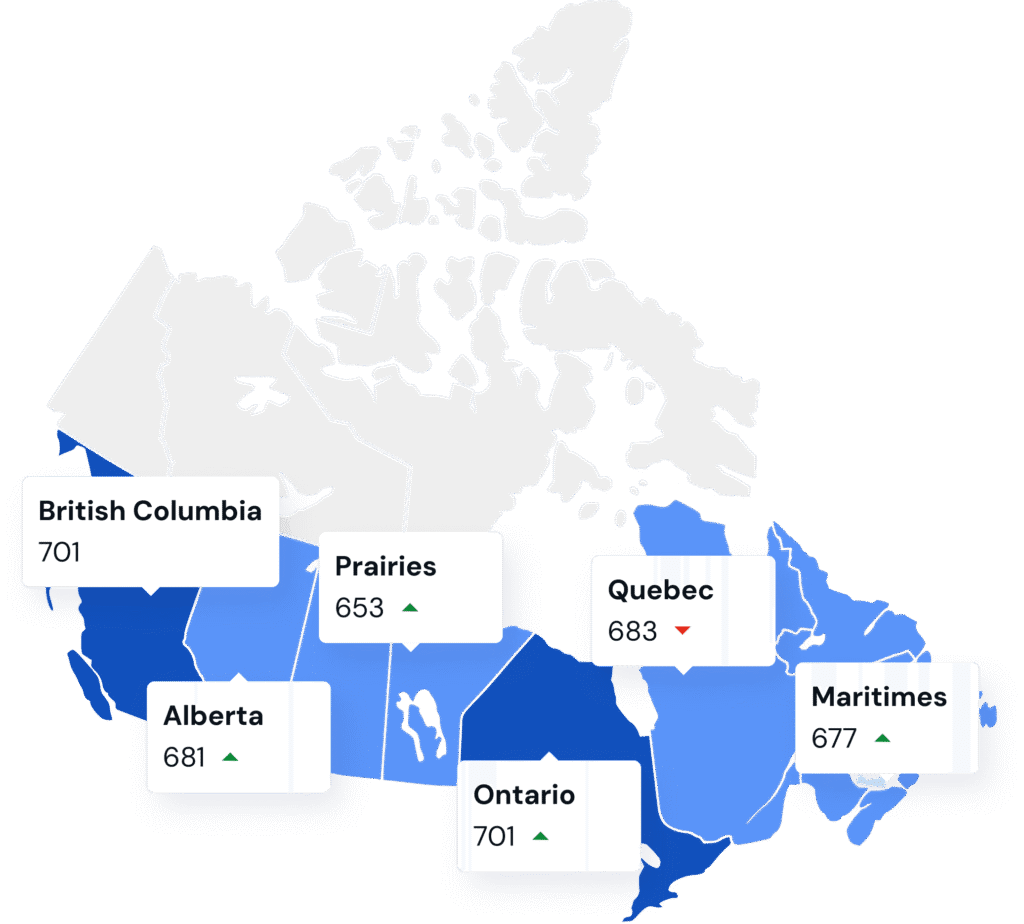

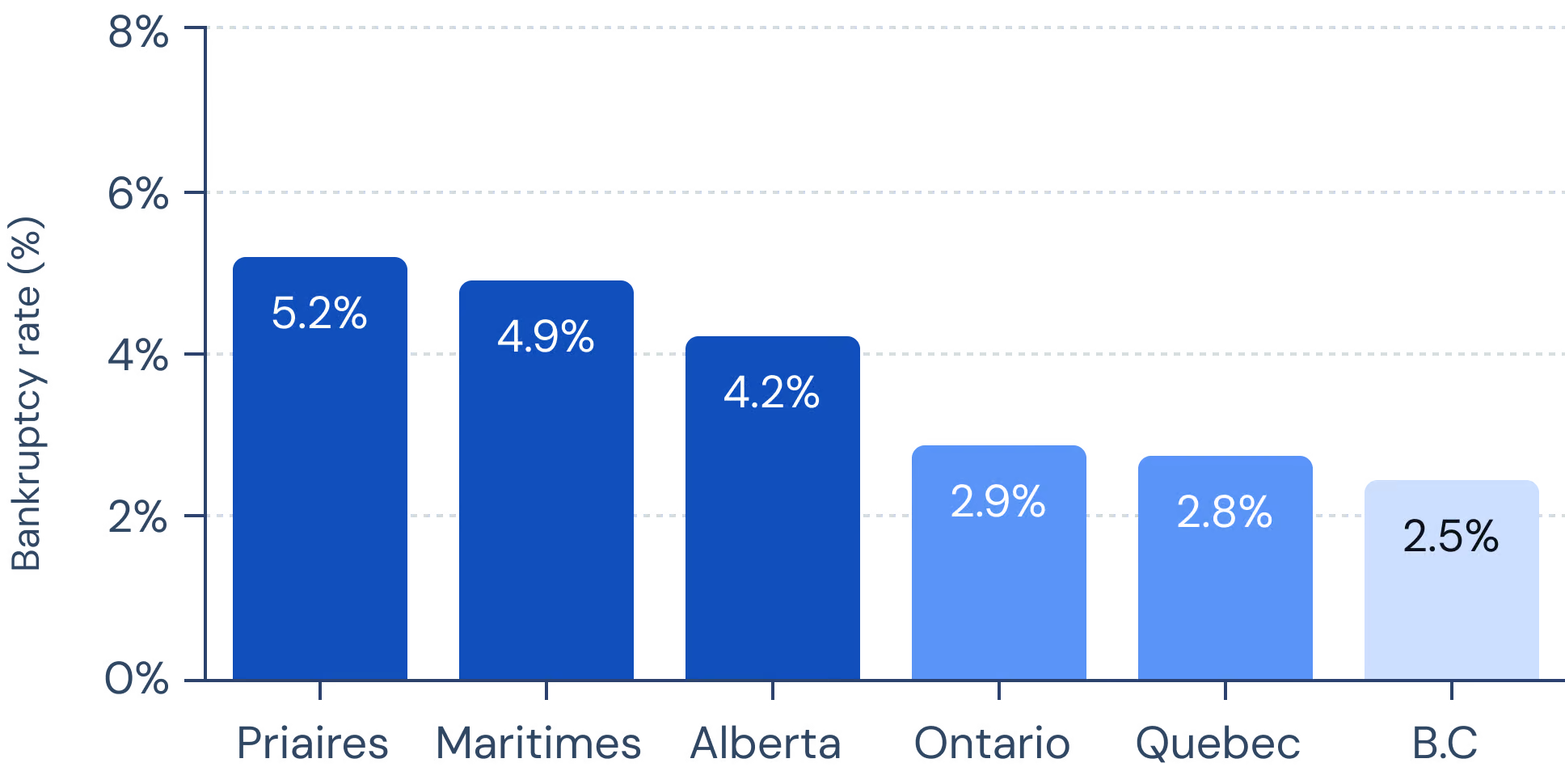

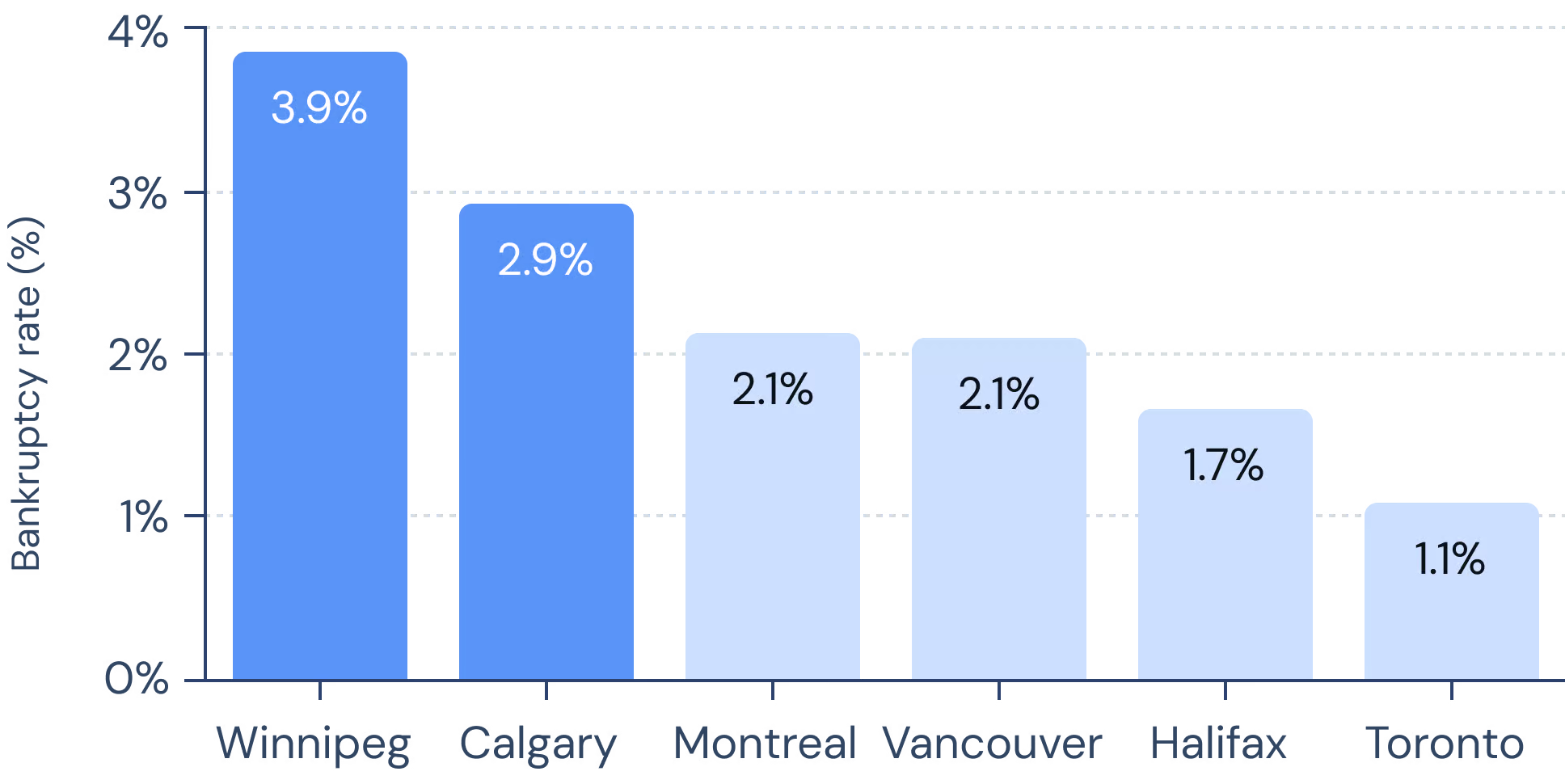

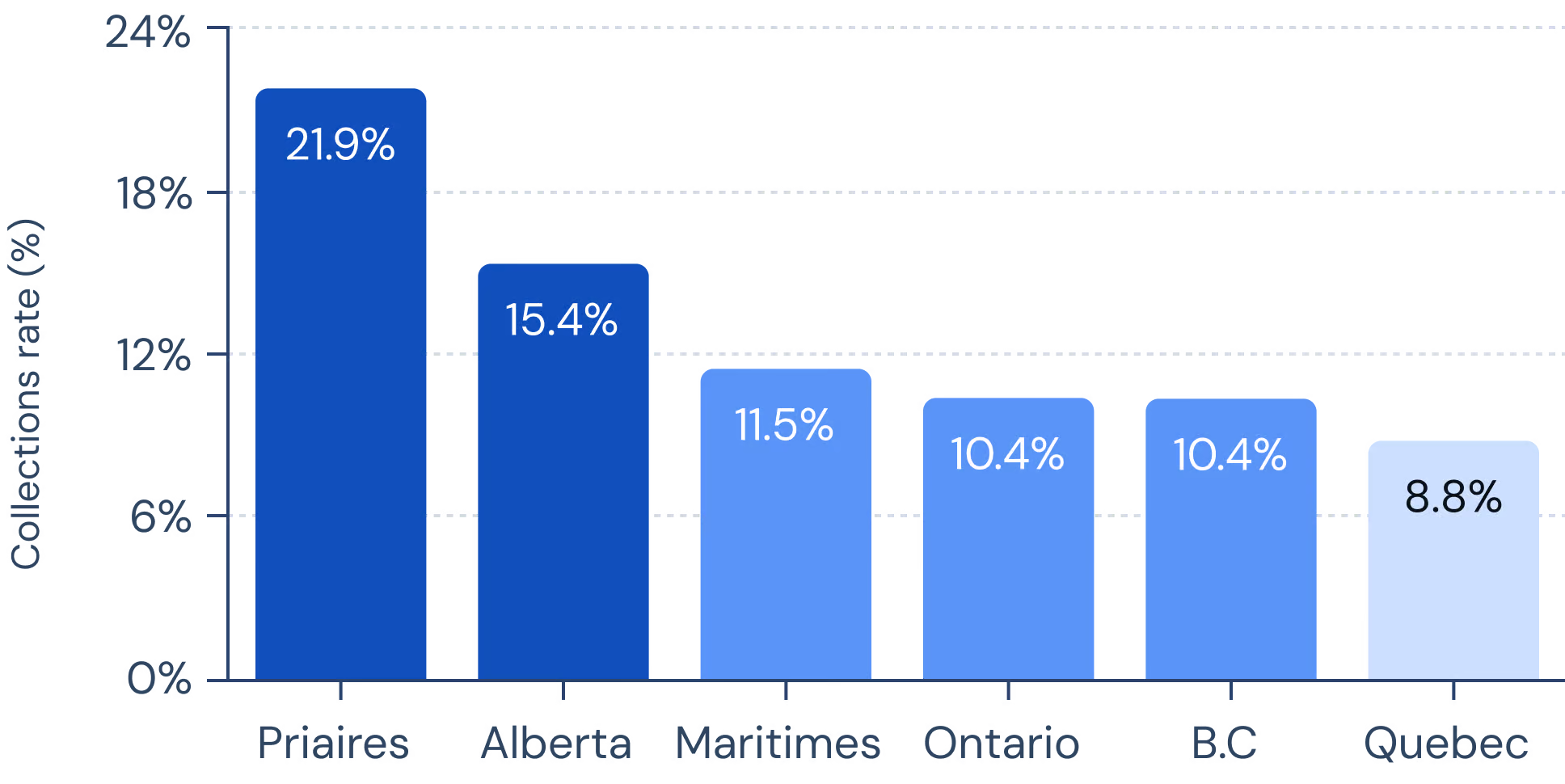

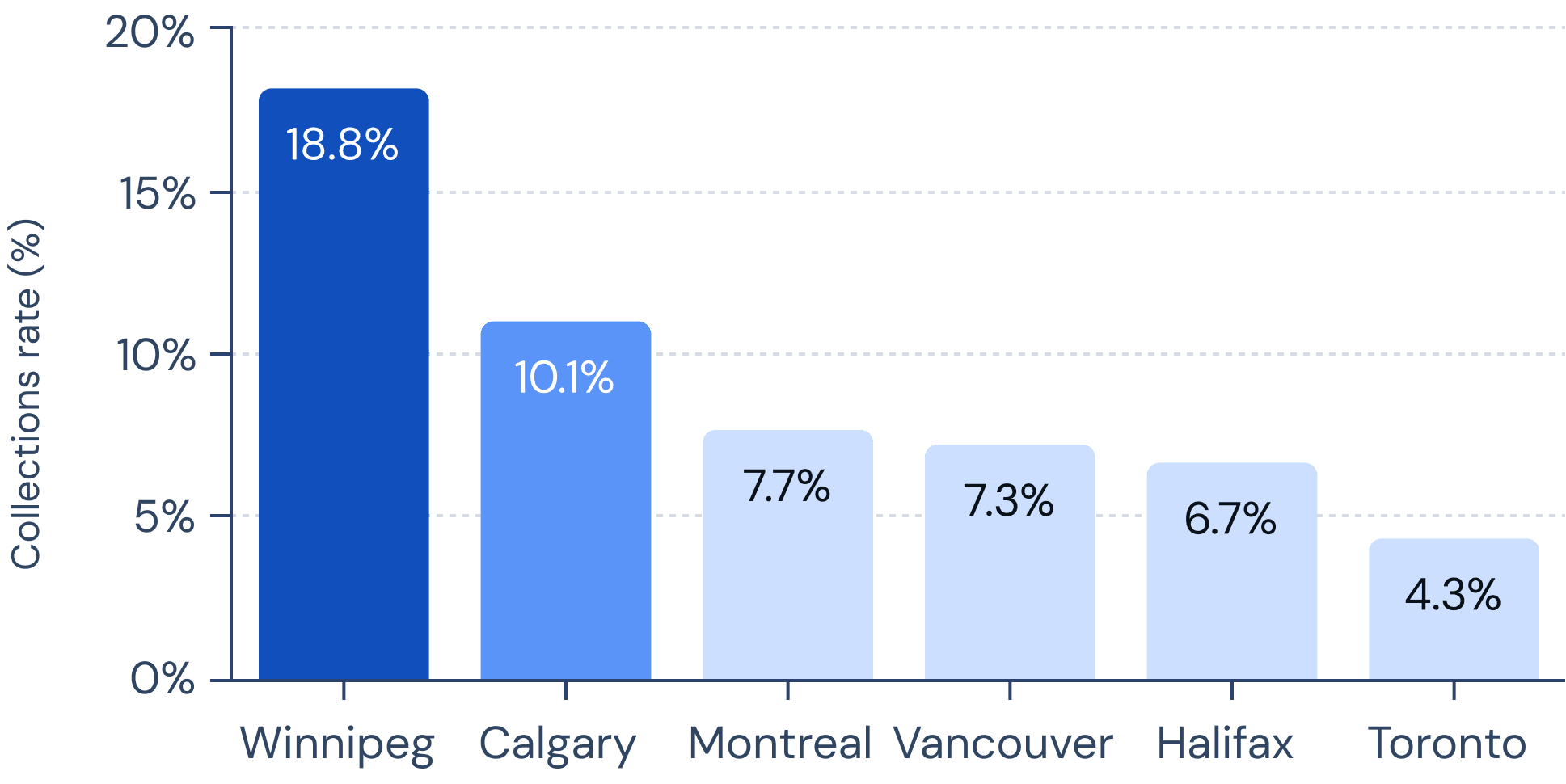

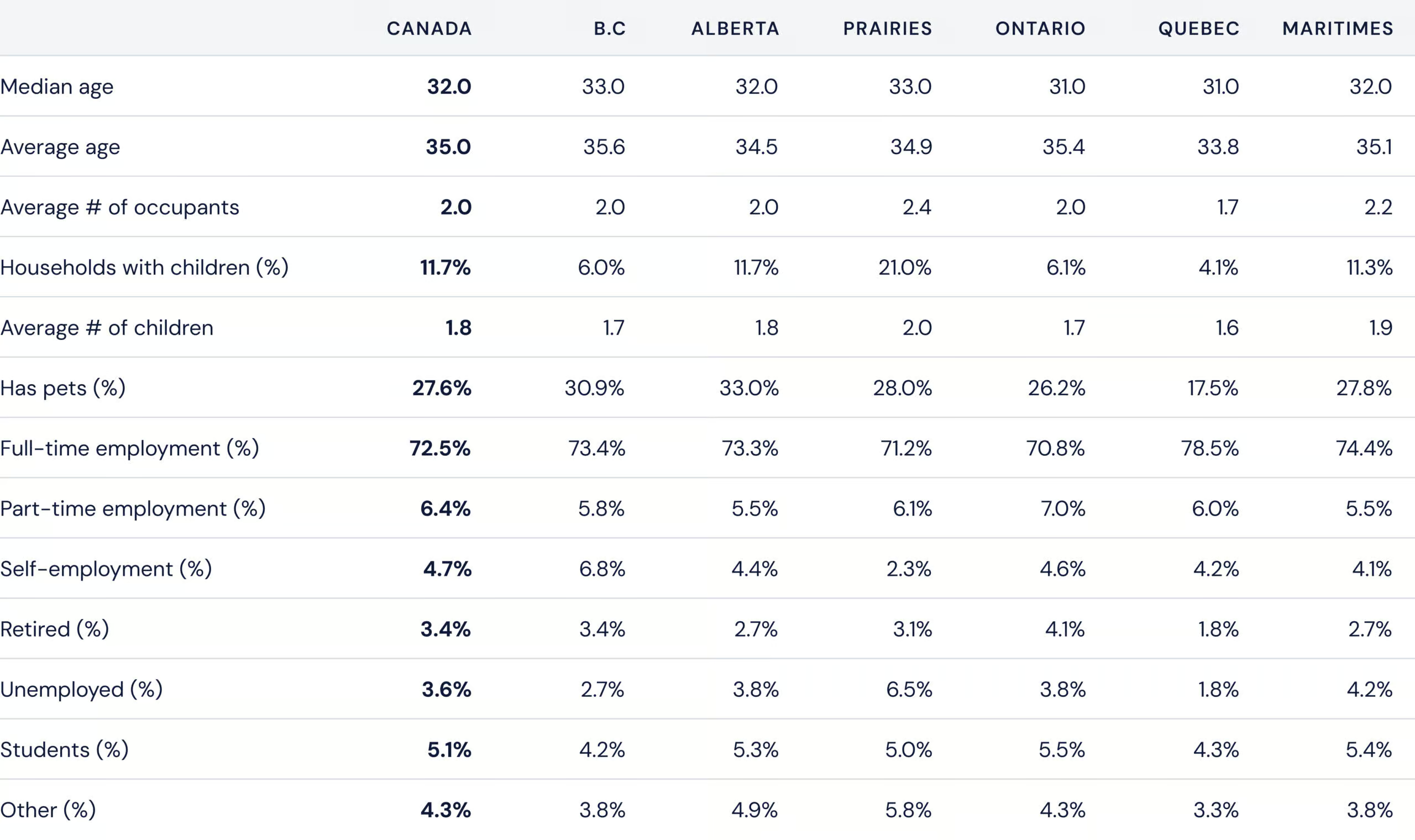

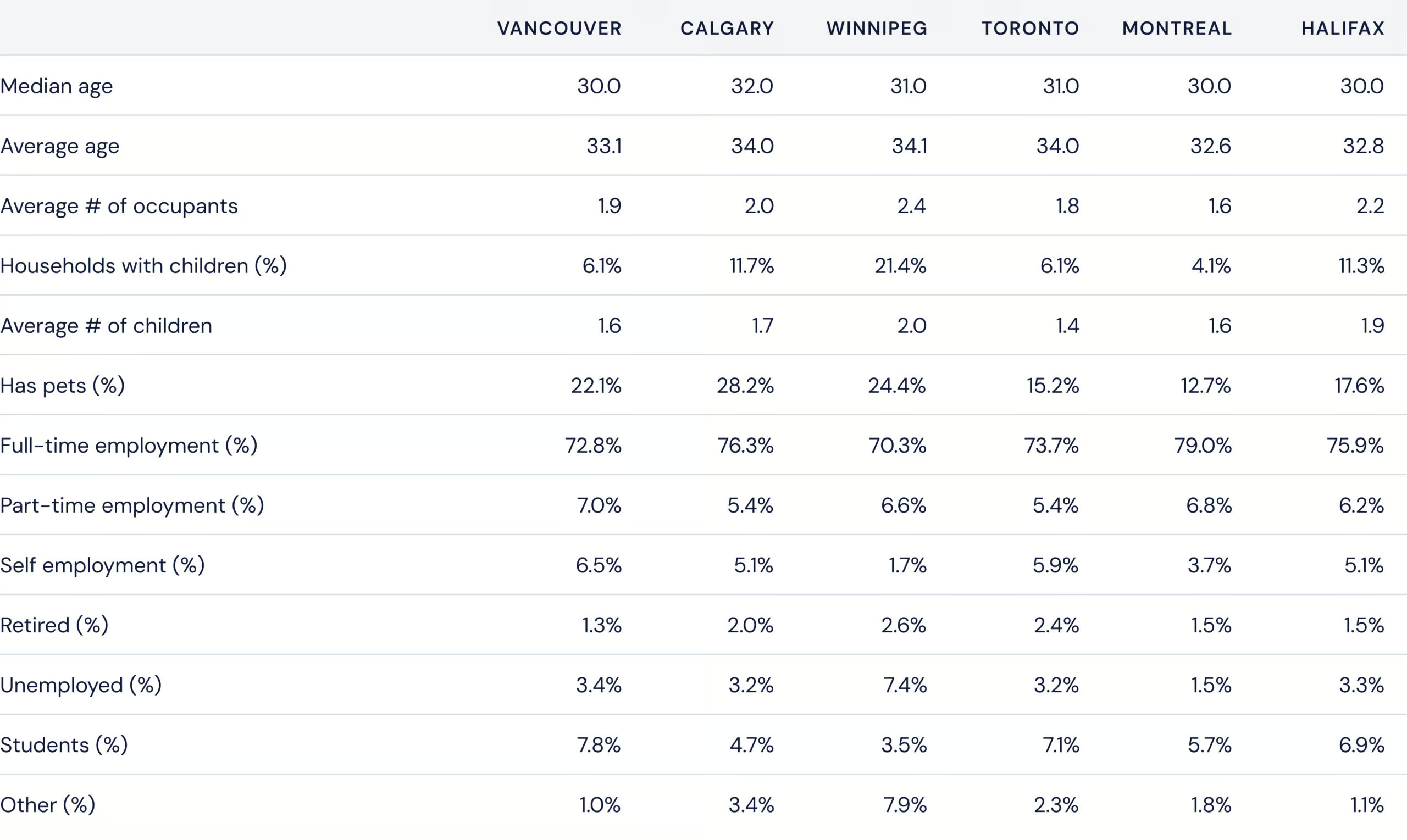

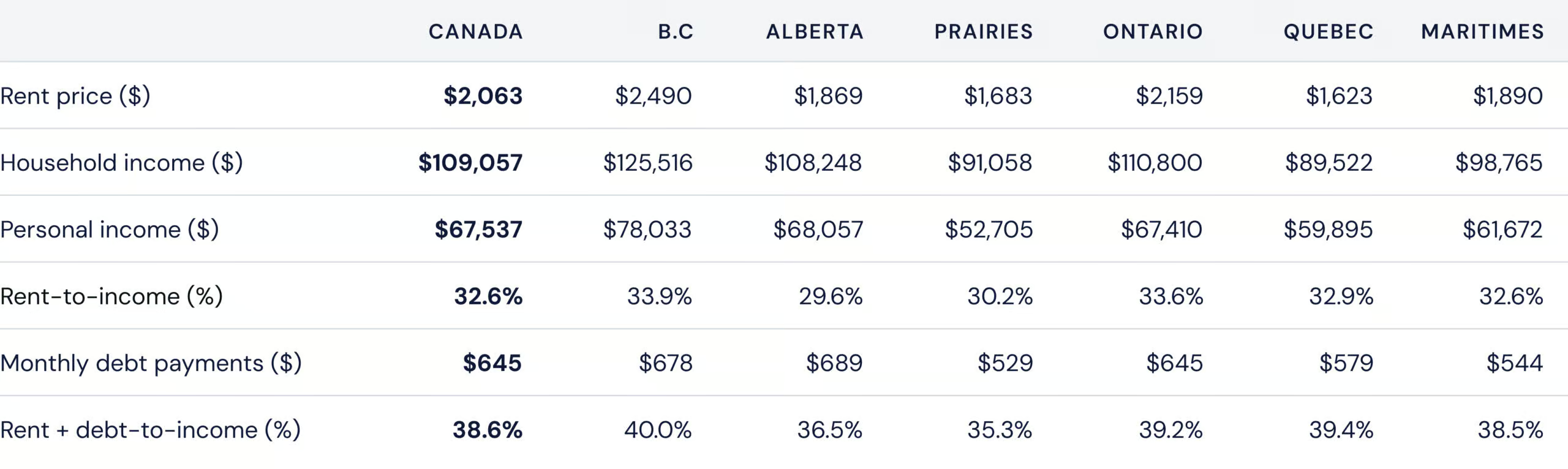

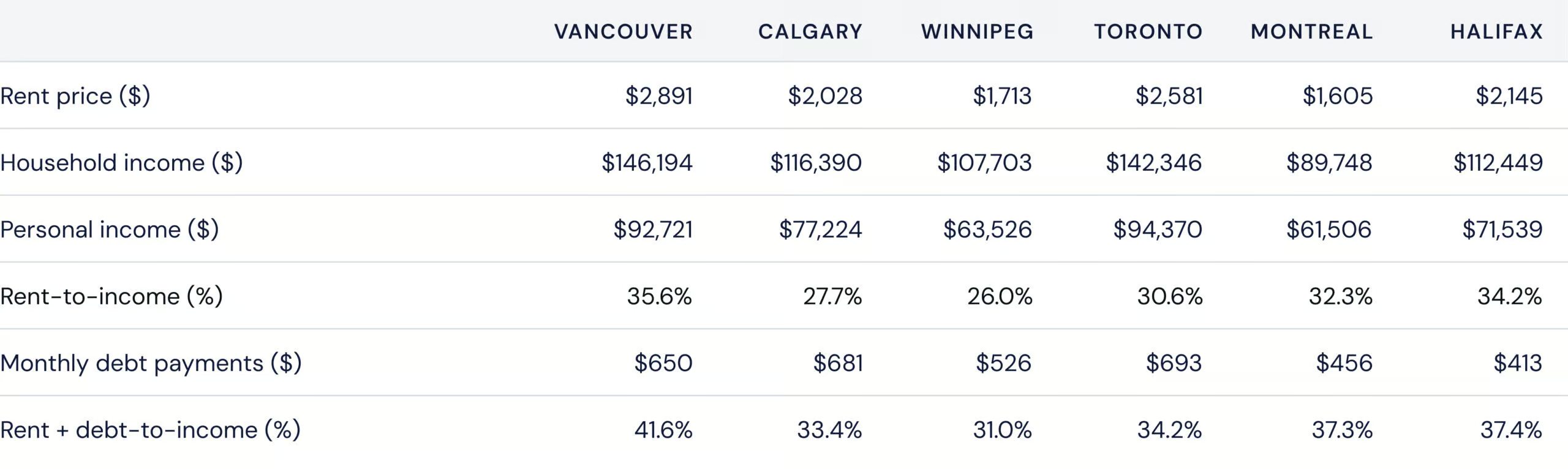

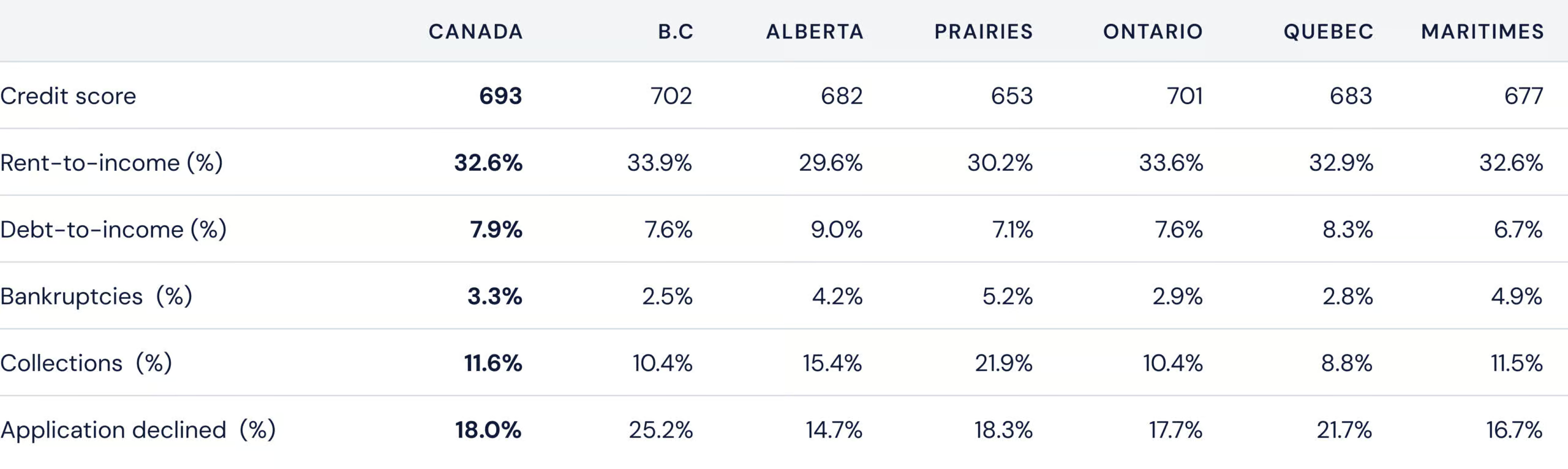

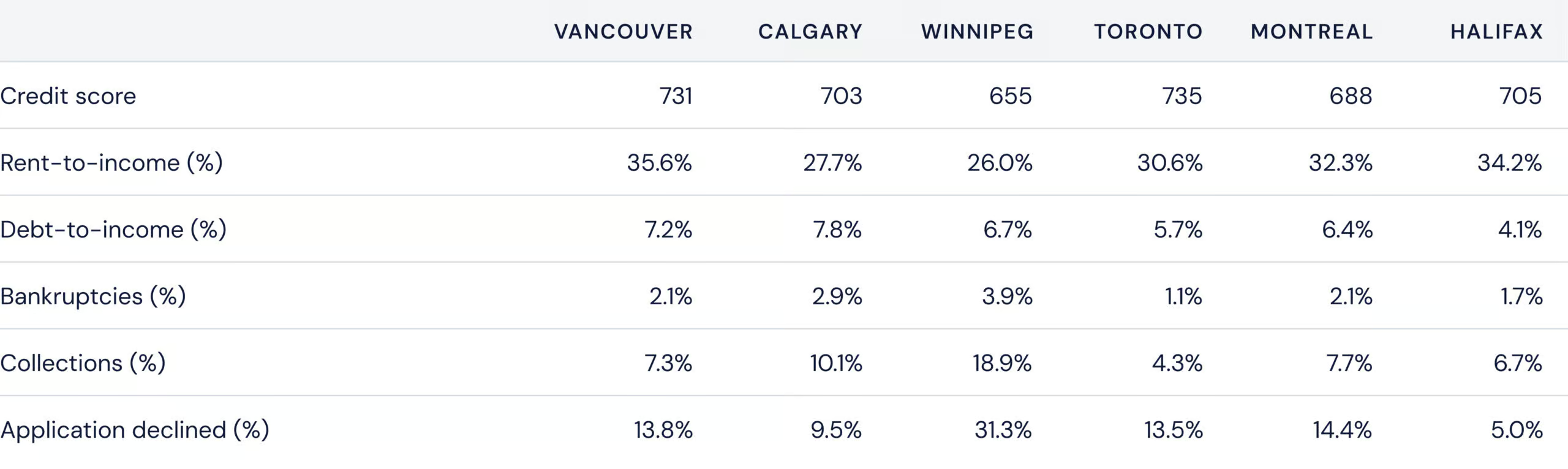

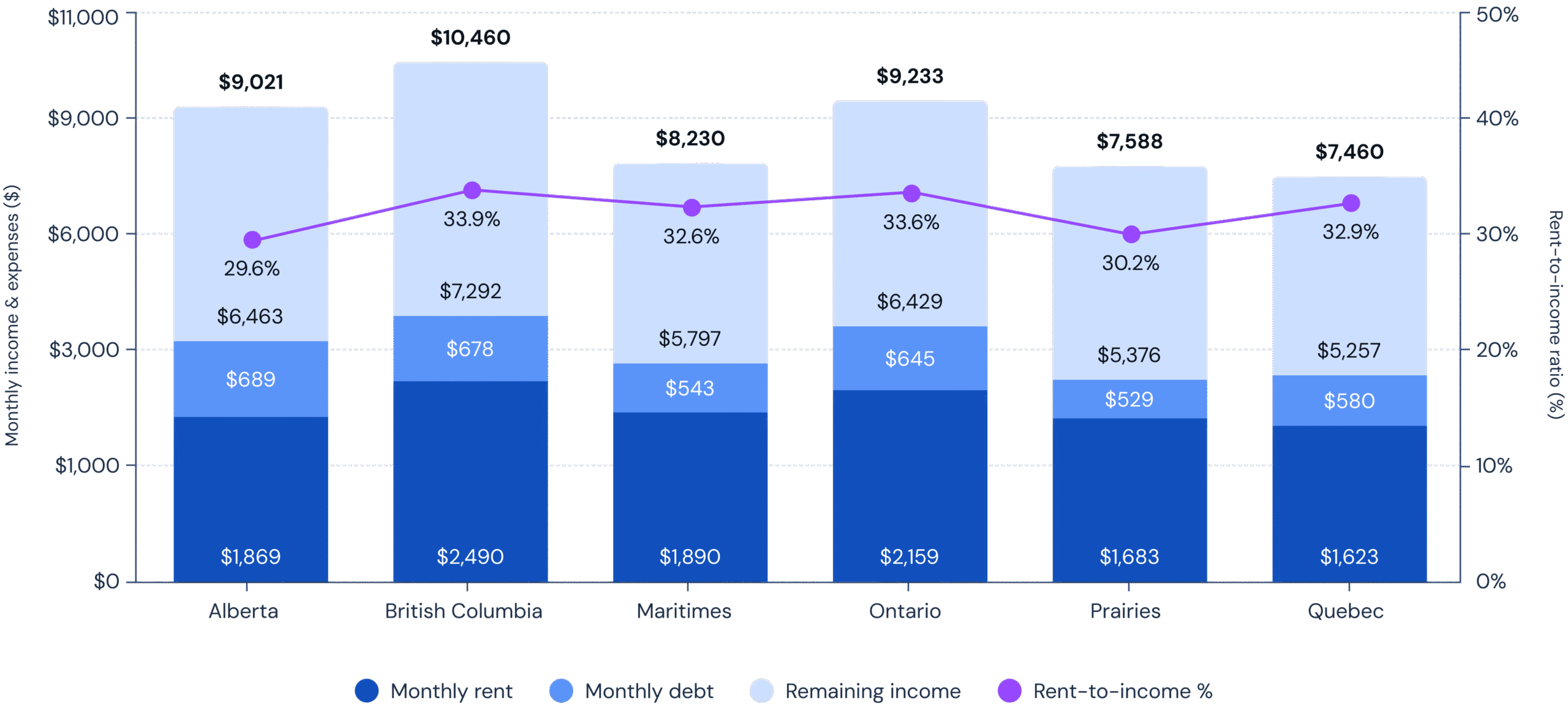

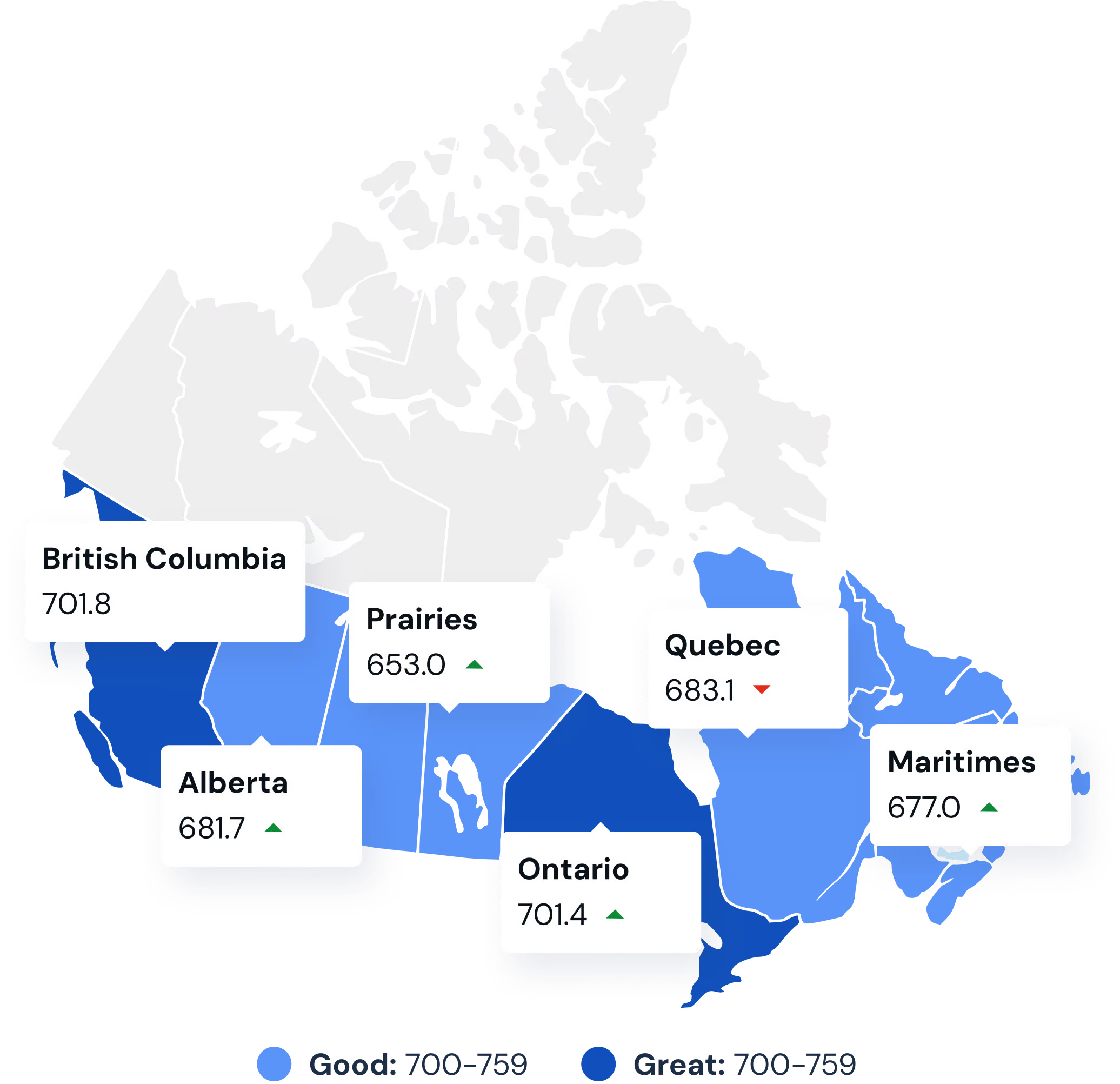

A look at Canada’s average renter profile, affordability, and risk trends based SingleKey’s Q3 2025 rental applications

Get approved for any lease by showing landlords you’re a risk free tenant

Stand out from other applicants with the background check trusted by landlords

Affordable tenant insurance to protect renter's property and liability

Build your credit with every rent payment

Blog

More Resources

Free Lease Agreement Forms for each province in one place

Conversations on real estate trends and property management strategies

Local tools and resources to help you manage your rental property successfully

Learn how to solve renting challenges from our experts

Articles on how to navigate the in-app SingleKey experience

A look at Canada’s average renter profile, affordability, and risk trends based SingleKey’s Q3 2025 rental applications

Get approved for any lease by showing landlords you’re a risk free tenant

Stand out from other applicants with the background check trusted by landlords

Affordable tenant insurance to protect renter's property and liability

Build your credit with every rent payment