- Credit Building

- 15 Minute Read

Rent Reporting On Credit Reports: The Ultimate Guide

Key Takeaways

- Rent reporting is the process of reporting your rent payments to credit bureaus, so that they count toward your credit score.

- Currently, only Equifax gathers and records rent payments on credit reports in Canada. To report your rent to Equifax, you must sign up with a third-party platform that offers the service–SingleKey is one example. Depending on the platform, you may need your landlord to participate in the reporting process.

- Your payment history accounts for 35% of your credit score—so reporting your rent is a no-brainer to give your score a healthy boost. With a higher score, you'll have access to more leasing opportunities and loans at low interest rates and favorable terms.

Updated on Nov 14, 2025

Written By:

Verified By:

Historically, paying rent on time has never had a positive impact on your credit standing in Canada (until recently). Mortgage holders, on the other hand, are rewarded with a steadily rising credit score as they make their payments. It was unfair, especially since rent is likely your most significant financial obligation.

However, things have changed. Bolstered by government support, cooperation from credit bureaus, and innovative solutions by the private sector, reporting rent is becoming increasingly common in Canada. In this guide, we’ll explain what rent reporting is, how it works, and why it’s worth starting today, and how to get started.

What is rent reporting?

Rent reporting is the process of sharing your rent payments with credit bureaus, which enables them to be reported on your credit report and contribute to your credit score.

Historically, credit reports only reflected financial information about loans and household bills, such as mortgages, auto loans, and utility bills. Rent payments were excluded and would never appear on your credit report. As a result, they played no role in shaping your credit score.

However, rent payments are increasingly seen as a sign of financial responsibility, which is why there’s a growing trend to include them as part of an individual’s credit history. The logic is that if you can handle rent payments, they should count positively toward your credit score. As a result, rent reporting in Canada is becoming more common and accessible.

Can you report your rent on your credit report?

Yes, you can report your rent on your credit report in Canada. However, rent reporting isn’t a task that’s done on your behalf by your landlord, like a typical lender would with loan payments you make. It’s up to you to take up the responsibility.

To include rent on your credit report, you must enroll in a rent reporting service, like SingleKey’s Rent Credit. Once you sign up and provide some basic details about your lease, your rent payments are tracked and sent directly to credit bureaus.

There’s one more critical detail to keep in mind: In Canada, you can only report your rent payments to Equifax. Currently, only Equifax accepts rent payment history and uses the data to calculate credit scores. TransUnion doesn’t collect rent payment information from landlords or tenants in Canada, so you won’t find rent payments on your TransUnion credit report.

Given this distinction between Equifax and TransUnion, you’ll likely have different credit scores, depending on which credit report you’re viewing. However, this isn’t something to worry about, as having multiple credit scores is quite common.

Can reporting rent increase your credit score?

Yes, reporting your rent is a proven way to establish or increase your credit score. By adding rent payments to your credit report, you can influence some of the key factors that shape your credit score:

Payment history. Your payment history accounts for a whopping 35% of your credit score, the most of any other factor. So, including your rent payments here can go a long way in boosting your score. The key is to pay on time consistently over a long period.

Credit history length. Adding rent payments to your credit file extends your overall credit history. This is a good thing, as experience in managing bills matters to lenders, landlords, and others who decide whether to trust you with loans, credit, and housing products. Credit history length accounts for about 15% of your credit score.

Credit mix. Do you use only credit cards? If so, adding a rent payment account to your credit file will diversify your credit mix, which lenders view favourably. While credit mix only accounts for about 10% of your credit score, having rent payments in there may kick it up a few notches.

Why is increasing your credit score important for your financial future?

Your credit score impacts your life more than you think, so this three-digit number is something worth paying careful attention to. Here’s why increasing your credit score matters for your financial future:

Easier approval for credit. With a higher credit score, borrowing opportunities will open up to you. Getting approved for a loan will be easier, as your positive credit history demonstrates that you consistently pay on time. Lenders will be more willing to grant you loans and offer you flexible terms after they conduct a hard credit check on you.

More access to rental housing. A landlord’s biggest fear is their tenant defaulting on their rent. So, as you improve your credit standing, you’ll experience fewer obstacles in getting approved for a lease. Your glowing credit history will stand out during the tenant screening process; landlords will see you as being dependable and trustworthy.

Lower interest rates. With a strong credit score, you’re more likely to qualify for loans at lower interest rates. Lenders reward borrowers who have a history of paying their debts on time. With a lower rate, you can save hundreds of thousands of dollars in interest costs over the life of a loan.

As SingleKey customer Steve B notes:

“If you can have better credit and you get a mortgage in the next five years, getting a 0.25% lower rate on your mortgage can save you thousand or hundreds of thousands—that’s a lot of money in the grand scheme of things.”

Better insurance options. In some provinces, insurance companies may consider your credit score when evaluating your eligibility for coverage or setting your premium. Having a healthy credit score can expand your insurance options.

Faster path to milestone purchases. A high credit score allows you to pay for major purchases that often require financing, such as a home, car, wedding, or vacation. It can even bail you out when you need a loan to cover an emergency expense.

How can you get started with rent reporting?

Adding rent payments to your credit report is pretty straightforward. The first step is to sign up with a rent reporting service provider. These are companies that collect and report your monthly rent payments to credit bureaus. They offer rent reporting as either a standalone service or as part of a broader range of services like rent collection and tenant screening.

To get approved, you usually have to provide a copy of your lease agreement as proof of your tenancy, plus a bank statement that shows past rent payments. Once you’re approved, you must submit evidence of your ongoing rent payments, either through landlord verification or by uploading a copy of your payment receipt. In some cases, you can link your bank account directly to the company’s platform, which simplifies the verification process.

From there, the rent reporting provider will forward each payment you make to Equifax. Eventually, your rent payments will appear on your credit report as a new tradeline account.

One thing to keep in mind when choosing a rent reporting service is that some require your landlord to participate in the process. If you prefer to self-report your rent payments, opt for a platform that allows you to do so.

What are the two credit bureaus in Canada and how do they measure your credit?

There are two major credit bureaus in Canada: Equifax and TransUnion. These companies gather and maintain financial information about how you use your credit. In turn, they use it to generate your credit report and determine your credit score. As noted previously, only Equifax allows rent reporting in Canada.

Both Equifax and TransUnion use complex algorithms to measure your credit score. The following are the primary factors that influence these scoring models:

- Payment history. A record of your debt payments, showing whether you pay on time, make late payments, or miss payments entirely.

- Credit utilization. How much of your revolving credit you’re using at a specific point in time.

- Length of credit history. How long you’ve had your credit accounts open, including the average age of your total accounts.

- Credit mix. The variety of credit products you use, such as car loans, credit cards, student loans, mortgages, and personal loans.

- New credit. The number of credit applications you submit and how often you do it.

How to report your rent in Canada

In Canada, several companies offer rent reporting services. Below, we explore some of the most popular ones to help you decide which is best for your needs and preferences. Keep in mind that free rent reporting services don’t exist—there’s always a cost to use them (though it’s usually quite reasonable).

FrontLobby

Cost: $4 per month

Frontlobby is one of the pioneers of rent reporting in Canada. It offers a platform that allows both tenants and landlords to submit rent payments, along with other services such as tenant screening and record-keeping. The company maintains a partnership with the Landlord Credit Bureau (LCB), which performs the actual task of transferring the rent payments it collects to Equifax.

Pros:

- Low monthly cost compared to other rent reporting platforms

- The service is free to use if your landlord has a premium FrontLobby account

- You get to create a Tenant Record with the LCB and monitor your rent payment history

Cons:

- Requires landlord participation—you can’t sign up to report your rent independently

- No option to report past rental payments

Borrowell

Cost: $10 per month

Borrowell is a fintech company that offers a range of credit management services to Canadians. It also offers the Rent Advantage program, which tracks and sends your rent payments directly to Equifax. To use the service, you must connect your bank or credit card account to the platform and verify each payment. A notable feature of Borrower’s rent reporting is retroactive reporting capability: you can report up to 24 months of past rent payments for a fee, which can provide an immediate boost to your credit score.

Pros:

- No need to obtain approval from your landlord—you can start reporting rent on your own

- Ability to back-report up to 24 months of rent payment history for a one-time fee of $69

- There’s a money-back guarantee if you see no increase in your credit score after 12 months

Cons:

- High monthly fee compared to other platforms

- You must log in monthly to confirm payments, which introduces extra steps

- The service isn’t compatible with certain payment methods, like cheques

SingleKey

Cost: $8 per month

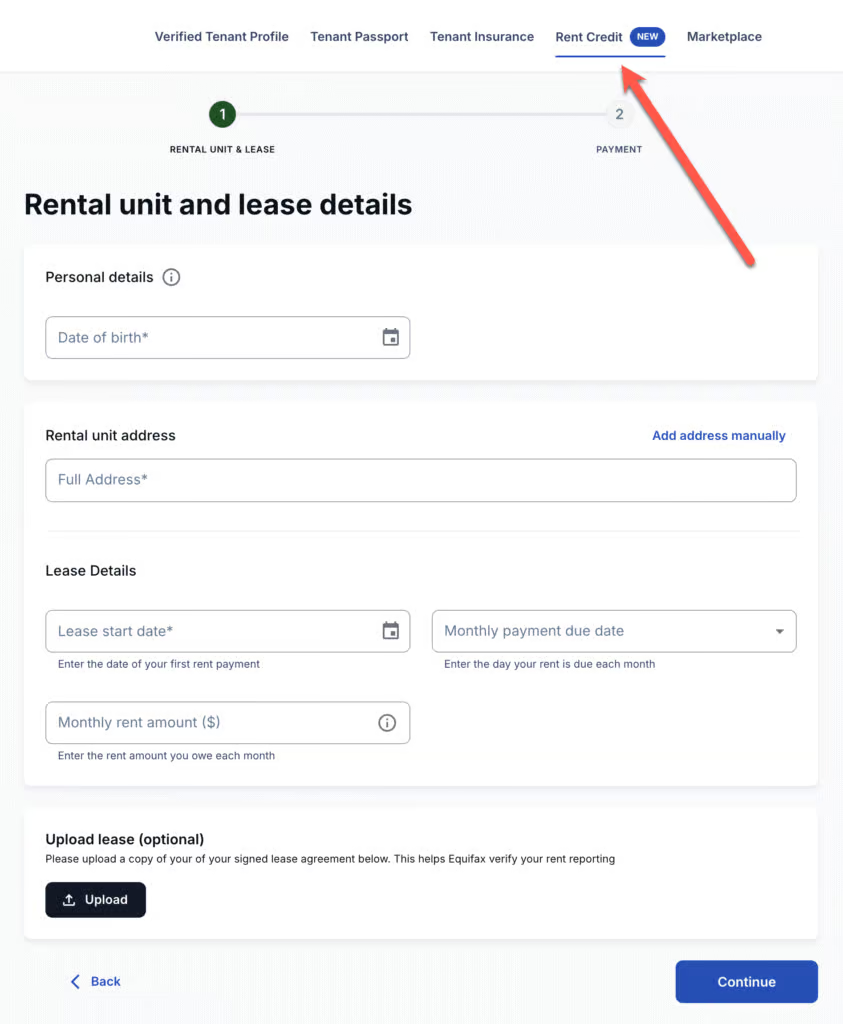

SingleKey is a Canadian-based rental services company that offers landlords and tenants tenant screening, rent guarantees, online rent collection, and more. It also provides an easy-to-use tool that allows you to report your rent to Equifax—and with no involvement from your landlord. To use the service, you must provide details of your lease agreement and submit proof of payment each month.

Pros:

- No need for your landlord to participate—you can sign up to use the service on your own

- Easy to use and set up an account—all reporting is automatic

- Includes 24-month rent reporting history for free

Cons:

- High monthly fee compared to other platforms

Zenbase

Cost: $2.90 per month or $9.90 per month plus 0.75 of monthly rent for extra features

Caveat: Must be made available in the building by your property manager. Not otherwise publicly available.

Zenbase describes itself as a “financial health platform” founded on ESG-inspired principles that promote socially responsible finance. It’s unique among rent reporting providers in that it allows you to split your monthly rent: you can pay half your rent upfront and the balance later in the month on your preferred date.

It offers several pricing tiers, depending on the type of service you’re after. Standard rent reporting to Equifax costs $2.90 per month (or $24.40 per year). Additional fees of $9.90 per month, plus 0.75 of your monthly rent, apply if you want access to the rent splitting feature. You can also report up to 24 months of past rental history for a one-time fee.

Pros:

- Flexible rent payment options: pay your rent in two installments each month

- Low monthly fee for reporting rent

- Retroactive reporting available for up to 24 months of past rent payments (one-time fee of $19.99)

- No participation from landlords required—you can report rent payments on your own

Cons:

- Zenbase has to be made available in the building by your property manager. You can’t sign up yourself if you’re not a resident in those buildings.

- The fees can quickly add up depending on the features you use

- Splitting rent payments adds an extra layer of complexity to rent reporting

- The CustomRent program (which permits rent splitting) doesn’t accept rent payments made by credit card

Koho

Cost: $18-$22 per month (or $12-$14.75 if paid yearly)

Koho is a fintech company known for its reloadable prepaid Mastercard that offers a wealth of features, including a spending account, high-interest savings, and global money transfers. It also provides rent reporting for tenants, which is integrated with its popular app,

To get started with Koho’s rent reporting feature, you must have a subscription to its Credit Building program or one of its paid plans. Rent payments can be made using the Koho app after registering, providing details about your lease, and setting up your payment details.

Pros:

- No landlord participation required to start reporting rent

- Multiple rent payment method are accepted (e-Transfer, PAD, Koho card)

- Ability to earn 0.25% on all reported rent if you bundle the service with tenant insurance

Cons:

- Accessing the service requires membership in one of Koho’s paid plans or enrollment in its subscription with its Credit Building program

- High monthly fee, especially if you don’t intend to use any of Koho’s other services

Chexy

Cost: Free, but there are transaction processing fees that range between 1.75% and 2.5%

Chexy is a platform that allows you to earn cashback and rewards points for paying everyday expenses, including utility bills, insurance, taxes, and rent. Additionally, it forwards your rent payments to Equifax. To report your, you must sign up for the company’s credit building service. Chexy will charge your credit card or bank account for the rent 3 days before it’s due.

While there’s no monthly fee to use the rent reporting features, you’ll incur a transaction fee for each payment. These fees range between 1.75% and 2.5%, depending on the type of credit card you use.

Pros:

- Ability to earn rewards points or cashback when paying rent by credit card

- No hidden costs or monthly fees to report rent payments

- No involvement from landlords required

- Multiple payment options are available (credit cards, e-Transfer, Visa, and Mastercard debit)

Cons:

- High transaction fees

- You need to have access to a credit card to collect rewards points or cashback on rent payments

City Lending Centers

Cost: $5 per month

City Lending Centers (CLC) is a lesser-known rent reporting provider in Canada, but it charges a reasonable monthly fee of $5 to use the service. For an additional one-time fee, you can take advantage of its retroactive rent reporting, giving you a head start in building your credit score. The CLC verifies each payment before sending it off to Equifax to ensure accurate reporting. It also provides short-term loans and a credit-building program.

Pros:

- Low monthly fee

- Ability to report up to 24 months of past rent payments for a one-time fee ($120)

Cons:

- Requires involvement from landlords who must verify each payment

- You must pay a one-time setup fee of $20 to get started

Screen applicants thoroughly with credit, background, and income verification—so you reduce risk, avoid surprises, and protect your rental income.

How do you report your rent with SingleKey?

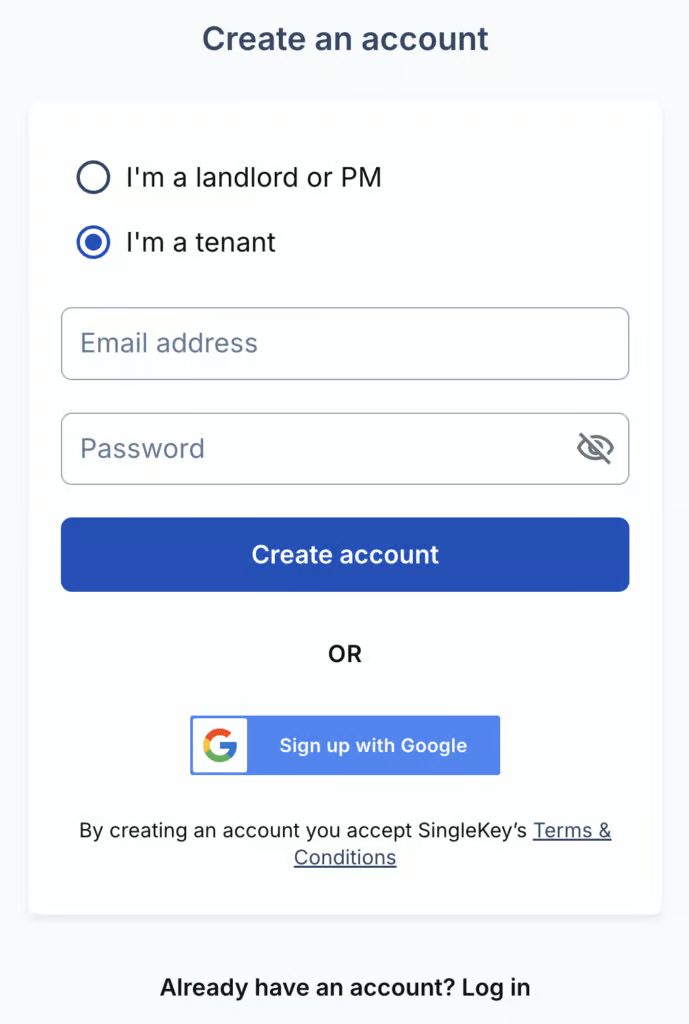

Step 1: Create a SingleKey account and signup for Rent Credit.

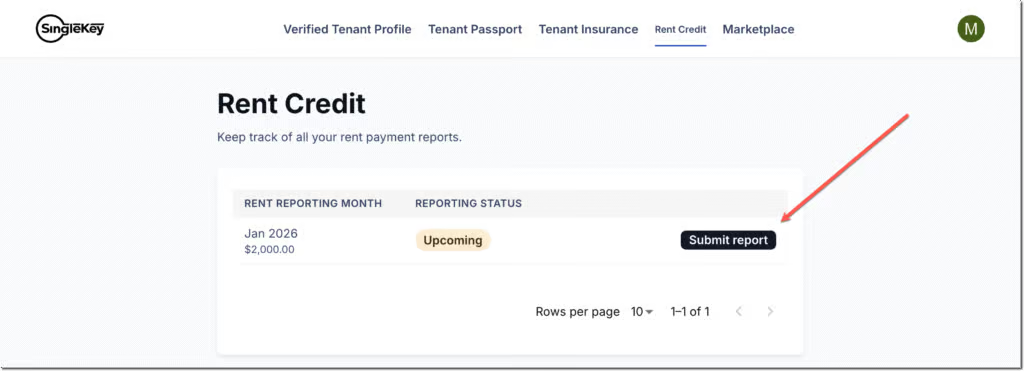

Step 2: Submit proof of payment

After paying your rent, return to the “Rent Credit” tab to report on SingleKey’s platform.

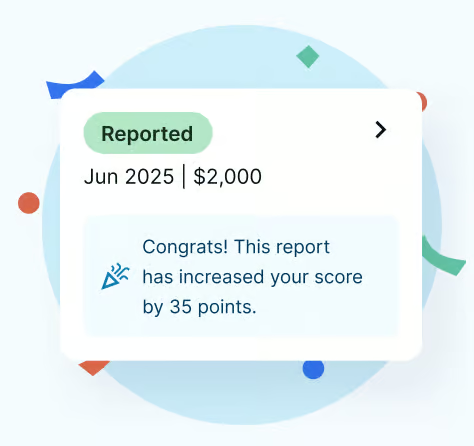

Step 3: Watch your credit score grow!

Our final thoughts

Renters have been largely neglected in Canada when it comes to credit reporting. But that’s all changed thanks to Equifax now accepting rent payment data and using it to calculate credit scores. While Equifax doesn’t accept rent payment history directly from tenants, you can sign up with one of many rent reporting platforms to get the job done.

If you’re a renter, don’t let your rent payments go to waste. Use them to establish or bolster your credit score. You’ll have a better shot at qualifying for loans, getting approved for leases, and achieving milestones like homeownership.

At SingleKey, we believe that renters deserve to be rewarded for being financially responsible. That’s why we’ve teamed up with Equifax Canada to allow you to report your rent payments and watch your credit soar. Get started with rent reporting today with SingleKey Rent Credit.