As a landlord, you may have been approached by someone wishing to lease your property to rent it out on Airbnb or a similar short-term rental platform. Welcome to the world of rental arbitrage!

Rental arbitrage can help you fill vacancies, boost your profits, and liberate you from many tedious tasks that come with running a rental property. However, it can also expose you to many risks, leading to costly bills, legal trouble, and endless headaches.

By knowing the ins and outs of this business model, you can determine whether or not to allow a tenant to engage in this type of business in your rental property.

What is rental arbitrage?

Rental arbitrage is a real estate investment strategy that involves leasing a property and then renting it out to another person. It allows individuals to earn rental income without owning a rental property. As such, it’s a shortcut to being a landlord. And it can yield lucrative returns if done right.

Rental arbitrage rose in popularity on vacation rental platforms like Airbnb, Vrbo, and HomeAway. Travellers flocked to these platforms to book a place to stay during their trips as they offered accommodation with more privacy, comfort, and amenities at affordable rates compared to hotels.

Eventually, people figured out they could capitalize on the demand for vacation rentals by renting a house, apartment, or other property and subleasing it to travellers. Airbnb, in particular, became the go-to platform for rental arbitrage opportunities, so much so that the term “Airbnb arbitrage” is often used. Tenants who sublease properties on its website are called “Airbnb hosts.”

In general, a tenant pursuing a rental arbitrage strategy won’t be the one living on your property (that would be travellers and other short-term guests). However, they’ll take charge of duties you’d generally assume as the landlord. These include advertising the property, screening tenants, and performing maintenance tasks.

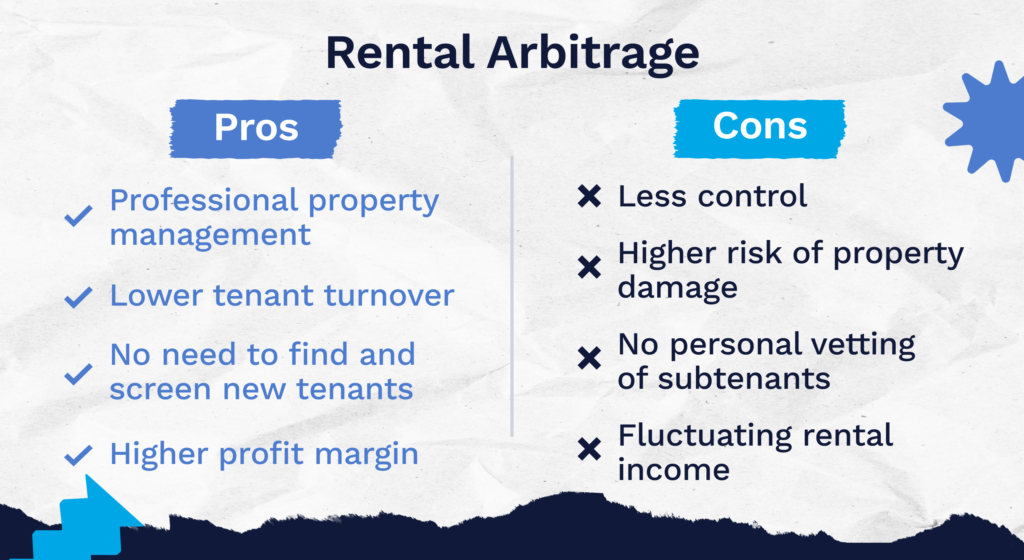

The pros and cons of rental arbitrage

Pro: Professional property management

A well-organized and reputable tenant will oversee cleaning duties, conduct minor repairs, and ensure your rental is well-maintained between guests. As a result, you’ll have more time to attend to other business needs.

Since the tenant’s target market is short-term renters, your property will likely benefit from superior upkeep as well. After all, they have a financial incentive to keep things neat and tidy to attract renters.

Pro: Lower tenant turnover

As long as their arbitrage operation is profitable, your tenant will likely stay with you for a long time. You’ll spend less time and effort searching for new tenants and benefit from a steady rental income.

Pro: No need to find and screen new tenants

Finding and screening suitable guests can be time-consuming and frustrating. Luckily, your tenant will relieve you of this task as it’ll be their responsibility to source and vet short-term renters. That means you’ll have more time to dedicate to other priorities, like expanding your rental portfolio.

Pro: Higher profit margin

If you allow your tenant to run a rental arbitrage business on your property, you could justify a higher rental fee to offset the additional risks you assume. You can also set up an agreement with your tenant to offer you a reasonable share of their profit.

Con: Less control

If you’re a hands-on property manager, relinquishing control to your tenant could be problematic. Because you won’t be in charge of most day-to-day decisions, you’ll have fewer opportunities to ensure things run smoothly. You’ll need to depend on your tenant to ensure nothing goes wrong.

Con: Higher risk of property damage

Rental arbitrage focuses on short-term tenancies, typically lasting one month or less. Due to the high tenant turnover rate, there’s a greater risk of a guest causing damage to your property. Of course, wear and tear will increase as well.

Con: No personal vetting of subtenants

Since the host bears responsibility for screening tenants, there’s a risk you could wind up with one or more troublesome individuals living in your rental. Essentially, you’re trusting the host to vet each subtenant competently. If they fail in this responsibility, issues can arise. For example, the subtenant may treat your property poorly.

Con: Fluctuating rental income

Your tenant’s rental income may fluctuate widely depending on your property’s location. As a result, they risk falling behind on their rent payments if they don’t generate enough income from short-term guests.

For example, if they cater your rental exclusively to tourists, a significant recession, weather event, or pandemic like Covid-19 could trigger a sharp drop in demand for their services. General seasonality will also affect bookings.

Managing rental arbitrage risks

If you’ve weighed the pros and cons of rental arbitrage and have decided to allow it on your property, it’s imperative to do extensive research on your potential tenant. They must be trustworthy, responsible, and competent enough to operate a successful rental arbitrage business.

Here are some of the critical factors to evaluate when screening a tenant who will be acting as a vacation rental host.

Website

Almost all businesses today have a website, so be sure to check how they present themselves online. A serious host should have a professional, well-organized website with helpful content that conveys a consistent brand. These are clues that suggest the individual or company takes their business seriously.

Licensing and regulations

Running a rental arbitrage business is perfectly legal in Canada. However, each municipality has regulations that govern the operation of short-term rentals. You’ll need to become familiar with them to ensure you and your tenant aren’t breaking any rules. Otherwise, you may pay a hefty fine or face a lawsuit.

Most municipalities classify short-term rentals as tenancy that lasts 30 consecutive days or less. Tenancy periods that exceed this limit are typically subject to different regulations.

Many cities require a vacation rental host to register their business, obtain a licence, and adhere to specific bylaws. Be sure to verify that your tenant meets these requirements. Also, confirm they can legally operate a short-term rental business in your district. Zoning regulations may prohibit short-term rentals in some city regions.

Another thing to note is that some municipalities have a primary-residence requirement. This regulation specifies that the host must live in your rental to operate their arbitrage business legally.

Liability insurance

To shield yourself from lawsuits and costly repair bills, ask your tenant if they have liability insurance. If something goes wrong, their insurance provider will step in to cover any claims involving injuries or property damage.

Some short-term rental platforms sell liability insurance policies, which your tenant may carry. For example, Airbnb offers AirCover for Hosts, which provides up to $1 million in coverage. If the tenant has their own insurance policy, that’s a good sign: it shows they’re trustworthy, professional, and reliable.

Suppose your tenant doesn’t have short-term rental insurance. In that case, you can purchase the coverage personally, adding it to your homeowner’s insurance policy.

Social media presence

Like a sleek and professional website, you can garner crucial information about your tenant’s business by examining their social media presence.

Check out LinkedIn, Facebook, Twitter, and other social media websites to see how they present themselves:

- Is their brand, messaging, and overall content consistent across each platform (and their website)?

- Are they active on each platform, posting regular messages, and responding to inquiries?

- Do they engage with their clients, landlords, and others within their industry?

Vacation rental profile

Ask your tenant to provide a link to their public profile on Airbnb, Vrbo, or whichever platform they list their services. Review the profile to assess how well they run their rental arbitrage business. Be sure to look at the following:

- Length of business history: The longer they’ve been around, the better, as it indicates they have plenty of experience running short-term rentals.

- Reviews: Are most customers raving about their service, leaving five-star reviews? If so, that’s a good sign.

- Level of detail: A profile that provides a lot of helpful information, including plenty of pictures, shows the host has nothing to hide.

- Response rate and time: Some short-term rental platforms show how quickly the host responds to inquiries. A fast response time indicates punctuality and solid communication, positive attributes you want to see. You can also test their timeliness by emailing or texting them several times and seeing how quickly they respond.

Our final thoughts

Depending on your risk tolerance, preferences, and goals, allowing rental arbitrage on your property may or may not be worth it. On the one hand, you may benefit from a reduced vacancy rate and superior upkeep of your rental. You’ll also have a lighter work schedule, as your tenant will handle most of your day-to-day tasks.

However, you may face an increased risk of property damage and missed rental payments from your tenant due to seasonality and unforeseen events. Plus, you surrender control of critical aspects of your rental business, such as screening guests.

If there’s one thing you need to remember about rental arbitrage, it’s this: always do your due diligence if you’re considering taking on a tenant whose goal is to sublease your property. Vet them thoroughly to ensure they’re honest, reliable, and competent:

- Do they have a successful track record in rental arbitrage?

- Do they possess the proper licence to run a short-term rental business?

- Are they familiar with the local laws surrounding the operation of short-term rentals?

- Do they carry adequate liability insurance?

- How sophisticated is their guest screening process?

Even if you’ve done everything possible to find the best tenant, it’s always possible things can go awry. The SingleKey Rent Guarantee Program protects landlords against tenant defaults on rent payments. By enrolling in the program, you’ll be eligible to receive up to $60,000 in lost rent over a maximum period of 12 months should your tenant default on their payments. You’ll also receive coverage for up to $10,000 in property damage.