Build your credit with every rent check

Build your credit with every rent check

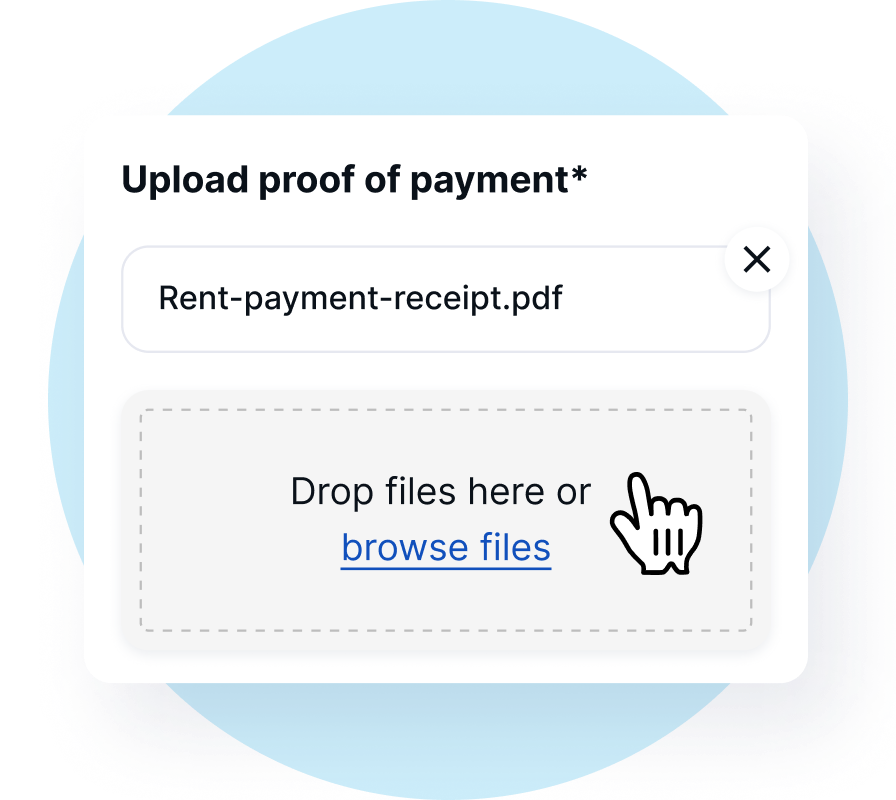

Strengthen your credit today by reporting on-time rent payments with Rent Credit!

🎉 Launch Special 🎉

Get 1 month free!

Join now to enjoy one month of free rent reporting.