Choosing a great tenant can save landlords from a lengthy and troublesome eviction process in the future. That’s why screening tenants is so important. Tenant screening services are available to assist landlords through this screening process by providing comprehensive reports on rental applicants. Using a tenant screening service helps landlords consider multiple tenants quickly and find the perfect match for their rental property.

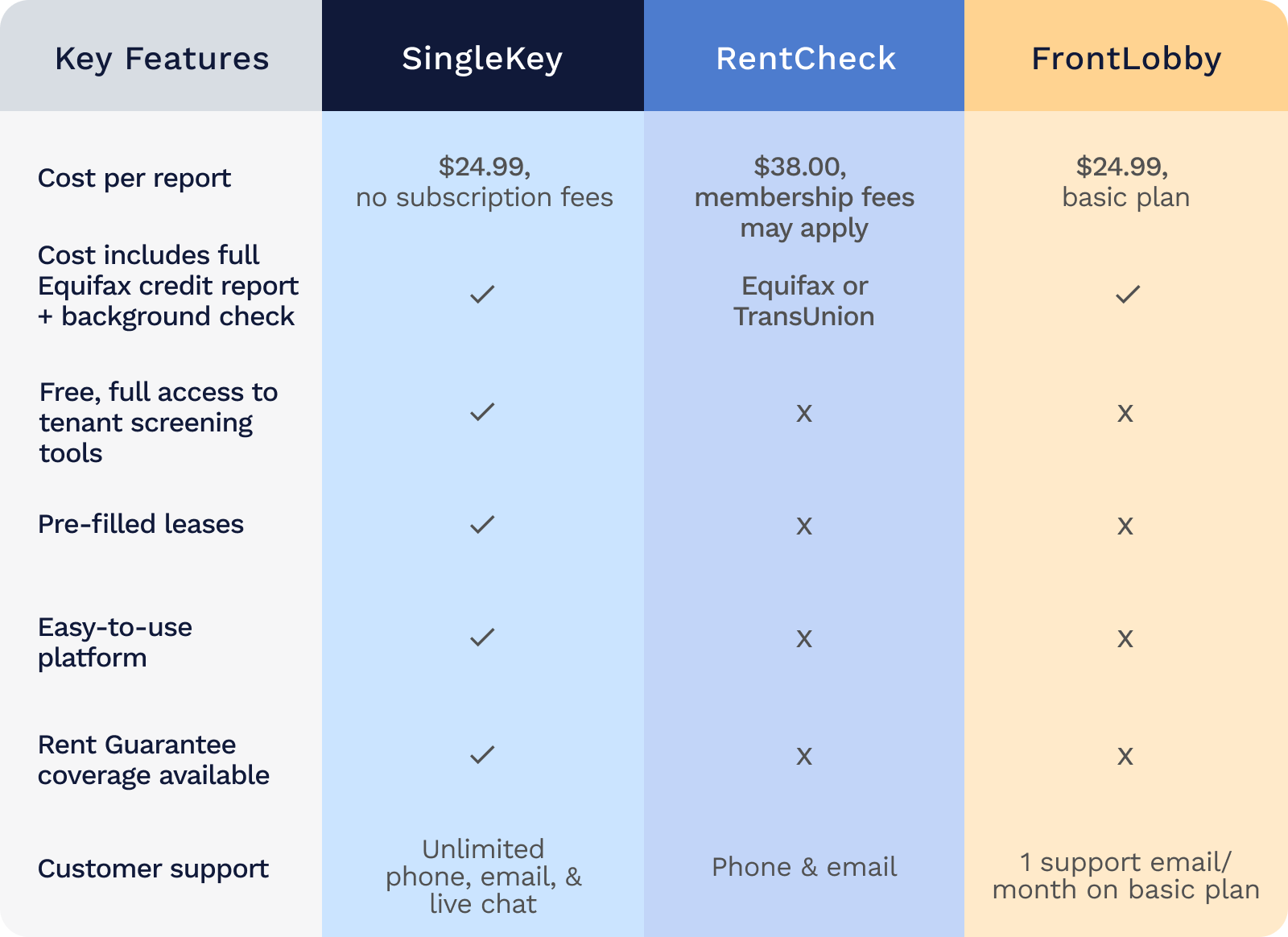

When choosing from the top tenant screening services in Canada, it’s important to understand what information is needed to screen tenants properly. The data provided in tenant screening reports can vary based on the service provider you use. Although these services can all provide a landlord with useful information, the level of detail, additional features, and price can differ.

Ranking the top tenant screening services in Canada

SingleKey

With results provided in less than 5 minutes, SingleKey offers a comprehensive tenant report that is easy to understand. It includes a full Equifax report with tradelines and records of bankruptcies and collections, as well as a background check, court record search, social media scan, and income and employment verification.

SingleKey offers a number of other free tools:

- A pre-screening tool that landlords can use before running a credit check to help narrow down the number of applicants

- Pre-filled leases after you approve a tenant (available in ON, BC, and AB, with more provinces coming soon).

- A free Rent Collection tool to help manage your monthly rent payments

- Team accounts that enable property management teams to stay connected

For an additional cost, SingleKey also provides a Rent Guarantee Program that helps reduce the risk of renting by covering rent payments—even if your tenant stops paying.

With SingleKey, there are two ways to order a report: you can either send the applicant an invitation through the platform so that they enter their own information and upload any supporting documents. If you already have the individual’s information and consent, you can also enter the tenant’s information.

Tenant reports cost $24.99 per report, and there are no subscription fees. There is also an option to have the tenant pay for their report when you send them an invite.

RentCheck

RentCheck is an established tenant screening service that has been around since 1976. They have several membership levels, with a $75 annual membership fee for the basic individual membership, and non-refundable, one-time fees for a credit card account setup ($29.95) and an invoicing account setup ($59.95). Members of approved associations may have the annual fee waived.

RentCheck’s credit reports for landlords start at $38, which gets you a report from Equifax or TransUnion with tradelines and other financial details, as well as the applicant’s tenancy history. Other reports can be added for a cost, including criminal records checks and PeopleTrace, which “tracks, monitors and locates individuals intentionally evading debt-repayment or legal authorities.”

FrontLobby

FrontLobby is another provider that offers a tenant screening service. They offer an Equifax credit report along with a background check that you can order separately or as part of a package. FrontLobby also provides other services, such as rent reporting to credit bureaus and a debit reporting tool, which can help landlords collect rent debt from a past tenant.

FrontLobby’s reports vary in price depending on the membership plan you sign up for. Their basic plan allows you to get the tenant screening bundle (credit report and background check) for $24.99, but you’ll only get one support email a month. With the premium plan, the tenant screening bundle costs $18.99, but there is a monthly fee of up to $30.50 per month. To access many of FrontLobby’s resources, tools, and unlimited support, a paid membership is required.

Key features that matter most for landlords

So, how do you decide which tenant screening service is best? Here are the key features that will help you streamline the rental application process and improve how you screen potential renters.

Detailed credit report

Information is power: a valuable credit report is one that contains everything you need to know to make an informed decision and choose the right tenant. If you only have a credit score though, you’re not getting the full picture of an applicant’s financial stability. Will the individual make rent payments on time? Are there any missed payments on the applicant’s credit accounts? Without these critical details, you could end up choosing the wrong tenant.

Fast credit checks

Today’s competitive rental market, combined with the backlog of cases in key tribunals, requires landlords to consider rental applicants quickly and carefully. To avoid potential tenant issues, it’s important to choose a tenant screening service that’s fast and thorough. A provider that can deliver an applicant’s credit score in less than an hour is incredibly useful in helping you make your decision.

Reporting that’s easy to understand

Have you ever tried to read a credit report and been confused about what you’re looking at? It’s great to receive a tenant screening report in a timely manner as long as you can easily understand it.

Most credit reports are written for lenders, not the average landlords. The most useful screening reports have key metrics, like rent-to-income ratio and monthly debt payments, spelled out in clear terms so that you have the information you need to to pick the perfect tenant.

Streamlined rental application process

Imagine having rental applicants complete an application by hand and then having to input all of that information online to receive a tenant screening report. Now picture doing that for dozens of applicants.

If you’re looking to save time, automate the rental application process. By having prospective tenants complete their application online rather than by hand, you’ll simplify the entire rental application process.

Extra support with tenant issues

One of the biggest fears as a landlord is that you’ll have a tenant who refuses or is unable to pay their rent. After all, you’ll still be expected to make your mortgage payments even if you aren’t receiving regular rent payments.

That’s why a tenant screening service that also offers a rent guarantee program is an asset. You’ll have some financial support to cover unpaid rent when unexpected issues arise.

Responsive customer service

Some customer service departments leave a lot to be desired. You can wait days for an answer or never receive one. When you need help, a responsive support team that can walk you through any issues in a timely manner is a key differentiator when looking for the best tenant screening service.

Our final thoughts

Canadian landlords have many great options when finding a tenant screening service to fit their needs. Many of the providers use different levels of membership plans to cater to different needs. SingleKey is the only tenant screening provider that offers a detailed, reliable, and easy-to-read report that’s ready in minutes. There is no subscription plan required with SingleKey, and all users get access to their free tools and resources. Learn more about the benefits of using SingleKey and start screening tenants more efficiently.